The Mortgage Bankers Association expects commercial and multifamily mortgage bankers to close $486 billion in loans backed by income-producing properties in 2021, an 11 percent increase from 2020’s estimated $440 billion, according to its latest forecast.

Tag: Coronavirus

MBA, Coalition Urge Homeowner Relief in COVID-19 Package

The Mortgage Bankers Association and nearly 300 other industry trade groups and community organizations urged Congress to include direct assistance to homeowners with COVID-19 hardships in any upcoming economic stimulus package.

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

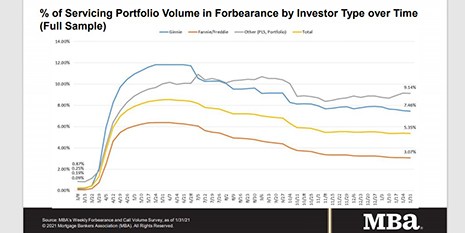

MBA: Loans in Forbearance Fall to 5.35%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.35% of servicers’ portfolio volume as of Jan. 31 compared to 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

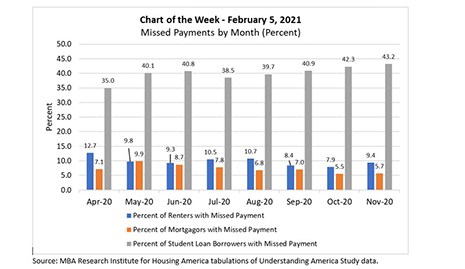

MBA Chart of the Week: Missed Payments By Month (Percent)

This week’s MBA Chart of the Week chart provides a preview of newly updated pandemic-related household financial insights that MBA’s Research Institute for Housing America released this morning, Feb. 8.

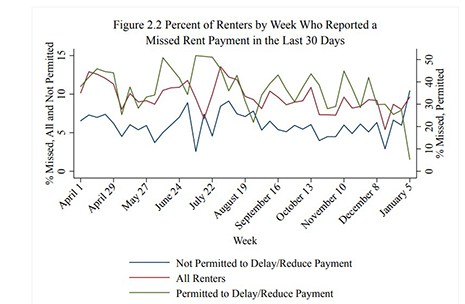

MBA RIHA Study Shows Progress, but 5 Million Renters, Homeowners Missed December Payments

Five million households did not make their rent or mortgage payments in December, and 2.3 million renters and 1.2 million mortgagors believe they are at risk of eviction or foreclosure or would be forced to move in the next 30 days, according to fourth-quarter research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

Mortgage Applications Increase in MBA Weekly Survey

Rates dropped; mortgage applicants pounced; and that’s pretty much the story, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending January 29.

CRE & Lodging Landscapes Post-COVID: Conversation with JLL’s Ryan Severino, Michael Huth

MBA’s Andrew Foster recently spoke with Ryan Severino and Michael Huth of JLL on the outlook for commercial real estate and in particular, the hotel/lodging sector in a post-coronavirus environment.

The CMBS Market During the Pandemic: Q&A with Dechert’s Richard Jones

MBA NewsLink interviewed Dechert Partner Richard Jones. He focuses his practice on sophisticated capital markets and mortgage finance transactions. He leads Dechert’s commercial mortgage-back securities team and serves as co-chair of the firm’s global finance group.

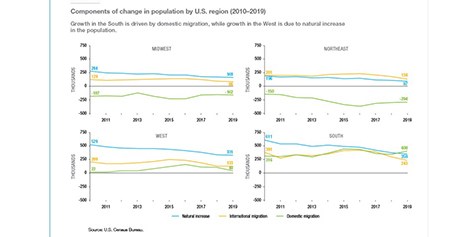

Freddie Mac: South, West Populations Growing 7X Faster than Rest of U.S.

Freddie Mac, McLean, Va., reported the U.S. population in the South and West grew seven times faster than in the Northeast and Midwest between 2017 and 2019.