While the falling home loan rates mean a booming business for the mortgage industry and a sign the housing market may help the U.S. economy avoid a true recession, it could also pose a challenge for those trying to process the influx of applications and requests. The digital mortgage servicing journey must focus on streamlining the process through technology and data-enabled solutions.

Tag: Coronavirus

MBA Survey: Share of Mortgage Loans in Forbearance Continues to Climb

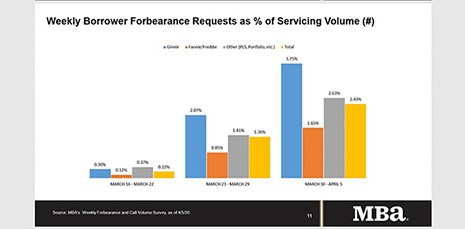

The surge in unemployment claims filed since mid-March resulting from the mitigation efforts to slow the spread of the coronavirus are straining household budgets and leading to more requests for mortgage forbearance. That is according to the Mortgage Bankers Association’s latest Forbearance and Call Volume Survey, which revealed the total number of loans in forbearance jumped from 2.73% to 3.74% during the week of March 30 to April 5.

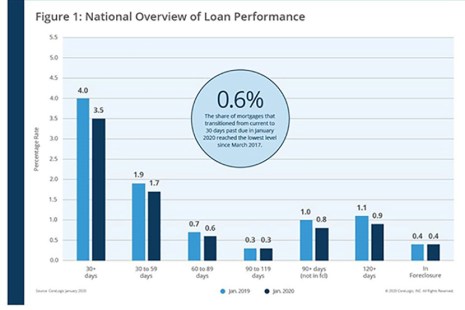

CoreLogic: Annual Delinquency Rates Fall for 25th Consecutive Month

CoreLogic, Irvine, Calif., reported 3.5% of mortgages in some stage of delinquency in January, an 0.5 percentage point decline in the overall delinquency rate from a year ago.

MBA Survey: Share of Mortgage Loans in Forbearance Continues to Climb

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans in forbearance jumped from 2.73% to 3.74% during the week of March 30 to April 5.

MBA Survey: Share of Mortgage Loans in Forbearance Continues to Climb

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans in forbearance jumped from 2.73% to 3.74% during the week of March 30 to April 5.

Michael Steer: Coronavirus Highlights Need for Pandemic Planning

Nearly all companies have engaged in some form of business continuity planning. Generally, this exercise centers around developing contingency plans for maintaining normal operations in the face of a natural disaster or IT outage. However, with concerns surrounding coronavirus sending shockwaves throughout the U.S. and global economies, mortgage companies would be well advised to add pandemics to their list of events that could disrupt normal operations, as this specific type of incident poses unique challenges.

Jennifer Henry: In an Uncertain Market, Servicers Are Leveraging Data, Technology to Drive Efficiency

While the falling home loan rates mean a booming business for the mortgage industry and a sign the housing market may help the U.S. economy avoid a true recession, it could also pose a challenge for those trying to process the influx of applications and requests. The digital mortgage servicing journey must focus on streamlining the process through technology and data-enabled solutions.

Mark P. Dangelo: Are Bankers Necessary? Part 2

At a time when the world is dealing with COVID-19—economic, political, social, medical, personal and even spiritual—it is up to financial services organization leadership to look forward to the lasting impacts on banking and finance. Innovation breadth during times of great crisis will not be challenged, and the operating result will be a very foreign landscape to those anticipating minimal post-crisis adjustments.

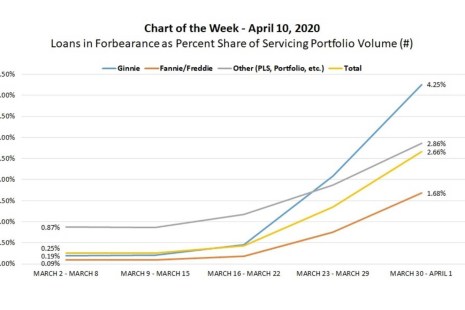

MBA Chart of the Week: Loans in Forbearance as Percent Share of Servicing Portfolios

New survey findings released by MBA this week highlight the unprecedented, widespread mortgage forbearance already requested by borrowers affected by the spread of the coronavirus (COVID-19).

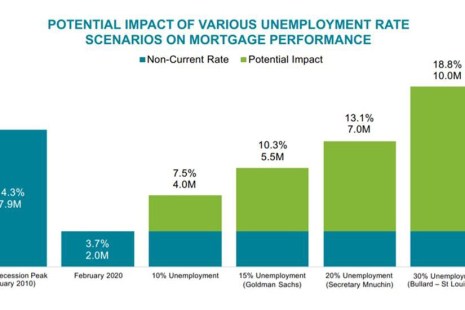

Black Knight: COVID-19 Unemployment Spike Triggering Surge in Mortgage Forbearance Requests

Leading up to the coronavirus outbreak, said Black Knight, Jacksonville, Fla., the vast majority of mortgage performance metrics were at or near record levels. Now, says Black Knight Data & Analytics President Ben Graboske, the mortgage market has been turned upside down.