Another 5.2 Million Fill for Unemployment; 4-Week Total Rises to 22 Million

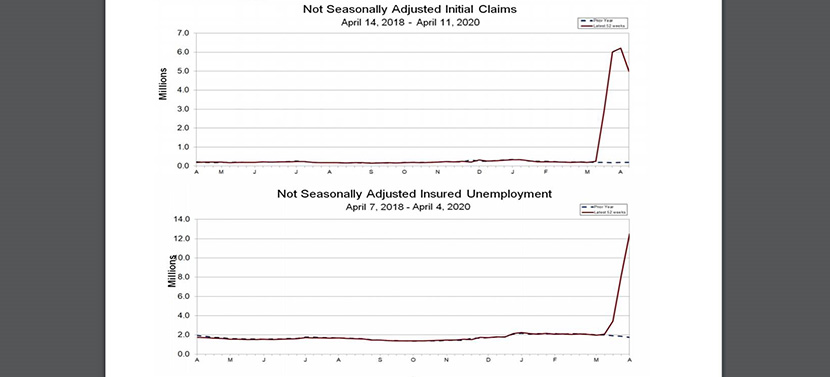

The Labor Department reported a seasonally adjusted 5.245 million people filed initial unemployment claims for the week of ending April 11, marking the fourth consecutive week of multi-million claims and bringing total claims filed in the past four weeks to more than 22 million.

However, the advance figure for claims ending the week of Apr. 11 was nearly 1.4 million fewer than the previous week. The four-week moving average rose to a record 5.509 million.

The report said the advance seasonally adjusted insured unemployment rate jumped to 8.2 percent for the week ending April 4, an increase of 3.1 percentage points from the previous week’s unrevised rate, marking the highest level of the seasonally adjusted insured unemployment rate in the history of the seasonally adjusted series. The previous high was 7.0 percent in May 1975.

“While initial claims for unemployment insurance dropped from the previous week, an additional 5.2 million people are out of work, with almost 12 million people currently on the unemployment rolls,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “This sudden drop in employment is unprecedented, and highlights the need for continued household support through rental assistance programs, extended unemployment insurance benefits, and other income-related efforts to help people weather this crisis.”

Jay Bryson, Acting Chief Economist with Wells Fargo Securities, Charlotte, N.C., noted while initial claims measure new applications for insurance—orthe flow into unemployment—continuing claims are a measure of the stock, or number, of unemployed. “The peak of new claims appears to have passed, meaning focus will now shift to the duration of unemployment,” he said.

Doug Duncan, Chief Economist with Fannie Mae, said the figures illustrate the degree of labor market distress that is being registered via reduced economic activity and falling consumer confidence measures. “On one hand, UI eligibility rules have been relaxed recently, increasing the number of people who are able to apply,” he said. “This makes it difficult to estimate the uninsured unemployed share of the workforce. On the other hand, many states reported a significant backlog of UI applications due to a lack of processing capacity, indicating that this week’s release may understate the true extent of insured layoffs. The recently enacted CARES Act is intended to help mitigate some of the negative shock to the labor market.”