In final installment of this series, the fall from business-as-usual likely met no one’s crisis modeling, strategy approaches or even risk mitigation scenarios. Yet, post-crisis analysis aside, how bankers and their brand names prepare for the “next normal” in an age of chaos and political fallout will likely define their survival against new competitors rushing into fill market voids.

Tag: Coronavirus

MBA: Share of Mortgage Loans in Forbearance Increases to Nearly 7%

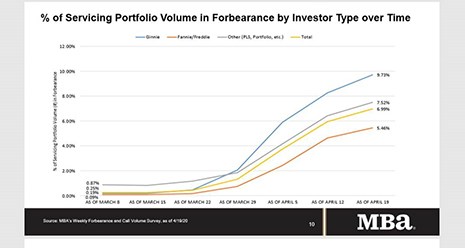

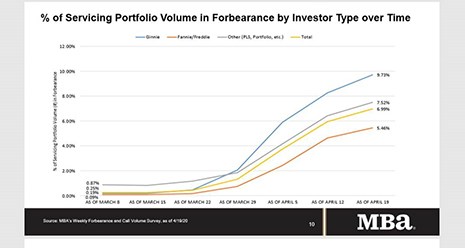

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 5.95% of servicers’ portfolio volume in the prior week to 6.99% as of April 19.

MBA: Share of Mortgage Loans in Forbearance Increases to Nearly 7%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 5.95% of servicers’ portfolio volume in the prior week to 6.99% as of April 19.

GSEs: No Lump Sum Required at End of Forbearance

The Federal Housing Finance Agency, Fannie Mae and Freddie Mac issued announcements yesterday reiterating borrowers in forbearance with a Fannie Mae or Freddie Mac-backed mortgage are not required to repay the missed payments in one lump sum.

Britt Faircloth: Fairness in the Face of Crisis–Fair and Responsible Banking in the Midst of Chaos

As a compliance officer, I have always recognized that change is constant, and I accept that fact sometimes grudgingly. While regulatory change generally has ample implementation or lead time, March 2020 has brought a different kind of change; one that is significant, sudden and jarring. These days you can’t just ask who moved your cheese—assuming you could find cheese in the grocery store, that is—you must quickly and effectively adapt to an entirely new normal.

Mortgage Action Alliance ‘Call to Action’ Urges Congress to Act on Liquidity Facility

The Mortgage Action Alliance, the grassroots advocacy arm of the Mortgage Bankers Association, issued a ‘Call to Action’ on Friday, urging its members to contact their members of Congress to support legislation that would provide lenders and servicers with liquidity support.

New Campaign Targets Lenders’ ‘Powerful Stories’ in Helping Communities Facing COVID-19 Challenges

A new campaign launched last week aims to showcase “powerful stories of businesses and organizations who are quickly pivoting to help their communities during these challenging times.”

Britt Faircloth: Fairness in the Face of Crisis–Fair and Responsible Banking in the Midst of Chaos

As a compliance officer, I have always recognized that change is constant, and I accept that fact sometimes grudgingly. While regulatory change generally has ample implementation or lead time, March 2020 has brought a different kind of change; one that is significant, sudden and jarring. These days you can’t just ask who moved your cheese—assuming you could find cheese in the grocery store, that is—you must quickly and effectively adapt to an entirely new normal.

House Democrats Add Pressure to Administration for Mortgage Servicing Liquidity

Twenty-seven House Democrats sent a letter yesterday to Administration officials urging them to take further steps to allow mortgage borrowers to avoid delinquency and to support mortgage servicers who are working with these borrowers.

March New Home Sales Feel Brunt of Coronavirus

The expected hit to new home sales from the coronavirus pandemic fully manifested itself in March, falling by more than 15 percent from February to its lowest level in six years, HUD and the Census Bureau reported yesterday.