Mortgage applications increased from one week earlier as key interest rates held steady, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending June 5.

Tag: Coronavirus

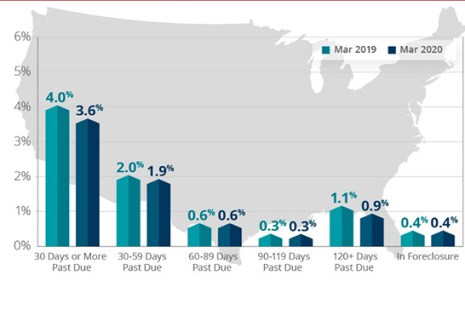

CoreLogic: Delinquencies Stay Low Despite Pandemic Impact

CoreLogic, Irvine, Calif., said its analysis of March mortgage delinquencies and foreclosures found despite the early impact of the coronavirus pandemic, delinquencies remained relatively low.

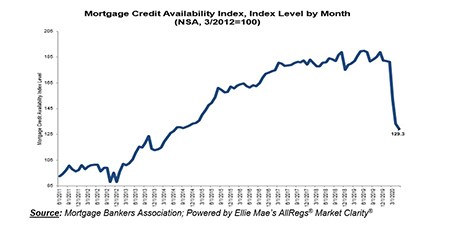

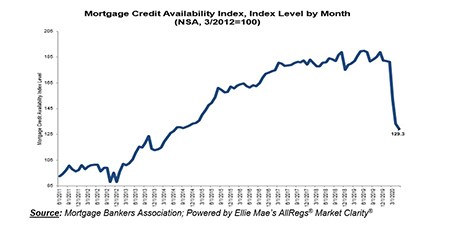

Mortgage Credit Availability Falls Again to 6-Year Low

Mortgage credit availability fell again in May, the third consecutive monthly decline, the Mortgage Bankers Association reported this morning.

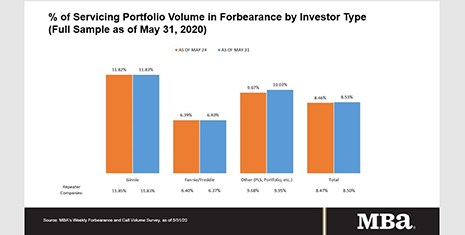

MBA Survey: Share of Mortgage Loans in Forbearance Slows to 8.53%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.

Chris McEntee of ICE Mortgage Services on COVID-19 and Impetus for the Digital Mortgage Process

Chris McEntee is President of ICE Mortgage Services, Atlanta, the business unit responsible the Mortgage Electronic Registration System (MERS), which is now part of Intercontinental Exchange Inc. He serves as a Director of ICE Mortgage Services, the governing board of MERSCORP Holdings Inc. and chairs the Company’s Compliance, Governance and Risk Management Committee.

Mortgage Credit Availability Falls Again to 6-Year Low

Mortgage credit availability fell again in May, the third consecutive monthly decline, the Mortgage Bankers Association reported this morning.

Whitepaper Examines COVID-19 Challenges, Future of Mortgage Industry

Altisource, Luxembourg, recently hosted a Mortgage Industry Pandemic Summit, featuring six sessions and 28 speakers, to discuss the major challenges facing the industry as well as possible solutions. Now, it has published a whitepaper summarizing the summit’s key ideas, best practices, guiding principles and analyst advice, as well as results and analysis of more than 20 poll questions.

Fannie Mae Home Purchase Sentiment Index Remains Near Survey Low

The Fannie Mae Home Purchase Sentiment Index increased by 4.5 points in May to 67.5, building slightly after nearing its record low in April. The survey indicated home buyers are much more confident in the current market than sellers.

Chris McEntee of ICE Mortgage Services on COVID-19 and Impetus for the Digital Mortgage Process

Chris McEntee is President of ICE Mortgage Services, Atlanta, the business unit responsible the Mortgage Electronic Registration System (MERS), which is now part of Intercontinental Exchange Inc. He serves as a Director of ICE Mortgage Services, the governing board of MERSCORP Holdings Inc. and chairs the Company’s Compliance, Governance and Risk Management Committee.

Tom Lamalfa: May 2020 Survey of Secondary Market Executives

What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancelation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008.