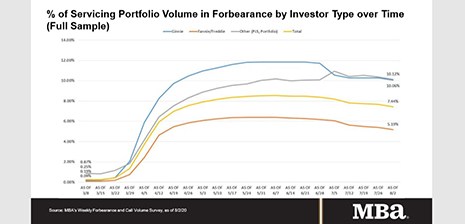

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

Tag: Coronavirus

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

LIBOR: The Floodwaters are Rising

In late 2019, the international financial industry generally considered the United States to be leading the way on LIBOR transition efforts. Then COVID-19 turned the world upside down and many companies had to shift resources to respond.

MBA: Second Quarter Commercial/Multifamily Borrowing Falls 48 Percent

Commercial and multifamily mortgage loan originations fell by 48 percent in the second quarter from a year ago and declined by 31 percent from the first quarter, the Mortgage Bankers Association reported in its Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Christopher Bennett: 2020’s Unprecedented Growth Requires Counterintuitive Thinking

As COVID-19 continues to affect the mortgage industry, lenders are realizing that conducting business as usual may not be possible or plausible. For a lender’s growth to reach new and different heights in 2020, new and different business practices, such as working with a hedge advisory firm, are required.

Record Share of Homebuyers Make Sight-Unseen Offers

Redfin, Seattle, said nearly half (45%) of people who bought a home in the past year made an offer on a property that they hadn’t seen in person, the highest share since at least 2015.

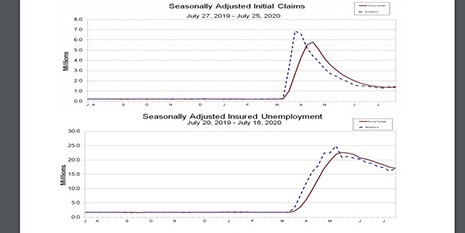

Initial Claims Rise for 2nd Straight Week

After improving—relatively speaking—through most of the spring, initial claims backslid for the second consecutive week, the Labor Department reported yesterday.

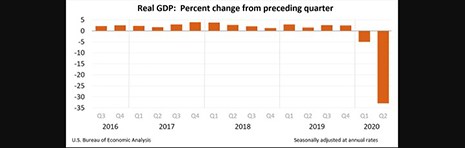

2nd Quarter GDP Takes One to the Chin

We were warned that second quarter gross domestic product data was going to be bad. Even so, the numbers that came out yesterday were off the charts–literally.

MBA, Trade Groups Ask Congress to Extend Troubled Debt Restructurings Relief Period

The Mortgage Bankers Association and a half-dozen other industry trade groups this week asked Congress to extend the “covered period” under the Troubled Debt Restructurings relief under section 4013 of the CARES Act.

Fed: No Change in Policy Anytime Soon

The Federal Open Market Committee yesterday said ongoing concerns about the coronavirus and the resulting economic stall means it will hold fast on its current policies.