2nd Quarter GDP Takes One to the Chin

(Bureau of Economic Analysis)

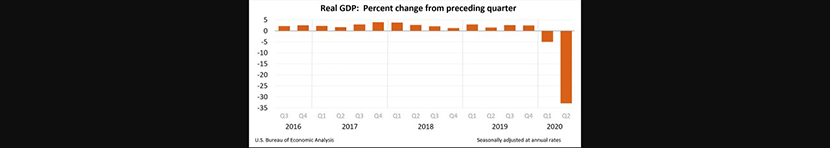

We were warned that second quarter gross domestic product data was going to be bad. Even so, the numbers that came out yesterday were off the charts–literally.

The Bureau of Economic Analysis reported its first (advance) estimate of 2nd quarter GDP showed a stunning 32.9 percent decline—the largest single quarterly drop in history, reflecting nearly one-third of economic growth gone in just three months. In the first quarter, real GDP fell by 5 percent.

BEA said the decline in second quarter GDP reflected the response to COVID-19, as “stay-at-home” orders issued in March and April were partially lifted in some areas of the country in May and June and government pandemic assistance payments were distributed to households and businesses. “This led to rapid shifts in activity, as businesses and schools continued remote work and consumers and businesses canceled, restricted or redirected their spending,”

The decrease in real GDP reflected decreases in personal consumption expenditures, exports, private inventory investment, nonresidential fixed investment, residential fixed investment and state and local government spending that were partly offset by an increase in federal government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

Joel Kan, Associate Vice President of Economic and Industry Forecasting with the Mortgage Bankers Association, noted, however, there is a potential silver lining. “In recent weeks, housing demand has rebounded sharply, and we expect the rest of the economy to recover in the second half of the year,” he said. “However, the adverse impacts to the job market and hardships for many households may persist – especially if virus cases continue to rise in several parts of the country. There are still many workers who have not returned to work, households in need of mortgage or rent forbearance and an overall sense of uncertainty ahead. We expect the Federal Reserve to keep rates low, and monetary policy supportive, until there are clearer signs of an economic recovery.”

Jay Bryson, Chief Economist with Wells Fargo Securities, Charlotte, N.C, said while monthly data suggest that GDP should bounce in the third quarter, uncertainties related to the pandemic continue to cloud the outlook later this year.

“Previously released monthly data left little doubt that a record would be smashed with today’s data release; the only question was the exact magnitude of the decline,” Bryson said. “In that regard, the plunge was not quite as severe as the 34.5% drop that the consensus forecast had anticipated. Nevertheless, this ‘miss’ is simply a rounding error in a drop of this size.”

Bryson said data show broad-based weakness in most of the spending components, “which comes as little surprise given that the economy was more or less shut down from mid-March through mid-May.” Looking ahead, he said the economic outlook at this time “is dependent on the evolution of the pandemic, which remains highly uncertain. To paraphrase a well-worn phrase, the only certainty at this time is uncertainty.”