MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

Tag: Coronavirus

MBA: July New Home Purchase Mortgage Applications Up 1% from June, 39% from Year Ago

The Mortgage Bankers Association this morning released its July Builder Applications Survey, reporting mortgage applications for new home purchases increased by 39 percent from a year ago and by 1 percent from June.

MBA Objects to GSE ‘Adverse Market Refinance Fee’

The Federal Housing Finance Agency yesterday authorized Fannie Mae and Freddie Mac to impose an “Adverse Market Refinance Fee”—a 50 basis-point fee on most refinance mortgages, effective Sept. 1. The after-hours announcements drew a strong rebuke from the Mortgage Bankers Association.

Mark Dangelo: Beyond Digital Transformation—A Tale of What is Coming

The leverage of all things digital is here. However, digitalization is NOT digital transformation, let alone digital leverage. As finance firms and their target markets reach their cycle peaks, the leverage of digital is a requirement most banking leaders have not incorporated into their forthcoming budgets and operations.

Record Low Rates Drive Mortgage Applications Increase in MBA Weekly Survey

Mortgage applications rose for the fourth time in five weeks as key interest rates once again fell to record lows, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 7.

Record Low Rates Drive Mortgage Applications Increase in MBA Weekly Survey

Mortgage applications rose for the fourth time in five weeks as key interest rates once again fell to record lows, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 7.

Brian Lynch: With Low Rates, Increasing Loan Volumes, Mortgage Companies Need More Access to Financial Reporting and Management Tools

As companies loan volumes continue to rise, so does the need for in-depth financial management and reporting tools that can help mortgage companies track and manage the month-over-month changes.

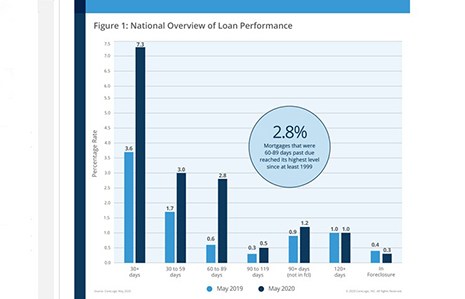

CoreLogic: ‘Clouds on The Horizon’ for Many U.S. Homeowners as Delinquency Rates Climb

Ahead of next week’s 2nd Quarter National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said early-stage and adverse mortgage delinquency rates increased for the second consecutive month, with all 50 states and more than 75% of U.S. metro areas seeing increases in overall delinquency rates.

MBA, Trade Groups Ask CFPB to Extend Comment Period on ECOA Request for Information

The Mortgage Bankers Association and nearly a dozen industry trade organizations on Aug. 10 asked the Consumer Financial Protection Bureau to extend the comment period on its Request for Information on expanding access to credit through Regulation B, which implements the Equal Credit Opportunity Act.

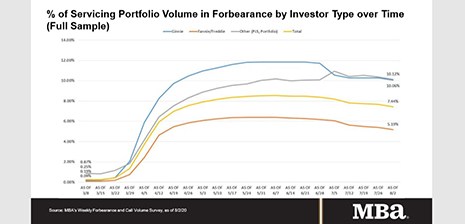

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.