The coronavirus pandemic has increased market interest in eMortgages, reported Fitch Ratings, New York.

Tag: Coronavirus

MBA: Share of Mortgage Loans in Forbearance Declines to 7.01%

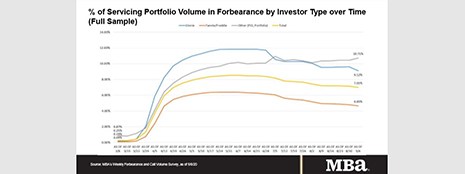

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 15 basis points last week to 7.01% of mortgage servicers’ portfolio volume as of Sept. 6, down from 7.16% the previous week. According to MBA estimates 3.5 million homeowners are in forbearance plans.

Debora Aydelotte: Mortgage Professionals Need to Prepare for COVID’s Impact into 2021

With the onset of the COVID-19 pandemic in the U.S. in early March, the better portion of 2020 has been devoted to adjusting to the “new normal.” Although expectations are high that a vaccine will be readily available by the year’s end, the situation is complex and defies a neat solution. Therefore, as leaders we need to think about how to prepare for what 2021 might hold.

For Houses, More Bedrooms; Apartments, Less Space

In this pandemic-induced new normal, size matters if you’re a homeowner: average size of new single-family homes are bigger today than they were 10 years ago while apartment sizes appear to be shrinking, according to a new report from StorageCafe.

Debora Aydelotte: Mortgage Professionals Need to Prepare for COVID’s Impact into 2021

With the onset of the COVID-19 pandemic in the U.S. in early March, the better portion of 2020 has been devoted to adjusting to the “new normal.” Although expectations are high that a vaccine will be readily available by the year’s end, the situation is complex and defies a neat solution. Therefore, as leaders we need to think about how to prepare for what 2021 might hold.

John Seroka: 6 Marketing Best Practices to Ensure Continued Business Growth During and Post-Pandemic

During COVID, you must ensure you are communicating clearly about your business and any changes that may be taking place in terms of how you are operating and the resulting impacts on applicants and borrowers.

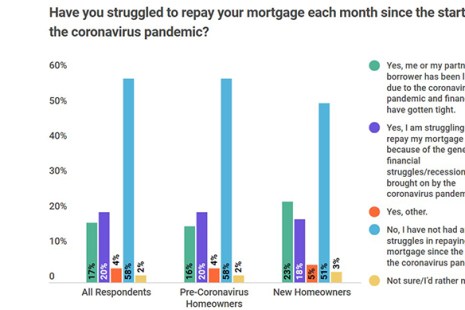

Regrets? For Some Homeowners During Pandemic, a Few

A new survey from LendEDU, Hoboken, N.J., finds more than half of new homeowners regret taking out a mortgage during the coronavirus pandemic, with most of them citing a job layoff as the reason for their angst.

Debora Aydelotte: Mortgage Professionals Need to Prepare for COVID’s Impact into 2021

With the onset of the COVID-19 pandemic in the U.S. in early March, the better portion of 2020 has been devoted to adjusting to the “new normal.” Although expectations are high that a vaccine will be readily available by the year’s end, the situation is complex and defies a neat solution. Therefore, as leaders we need to think about how to prepare for what 2021 might hold.

Administration Issues Nationwide Eviction Moratorium Through Dec. 31

Citing the need to “prevent the further spread of COVID-19,” the Trump Administration on Sept. 1 issued an order temporarily halting residential evictions through Dec. 31.

Mortgage Applications Down for 3rd Straight Week in MBA Weekly Survey

Mortgage applications fell for the third straight week even as interest rates dipped again, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending August 28.