Paul Anselmo is CEO and founder of Evolve Mortgage Services and SigniaDocuments Inc, a provider of outsourced mortgage platforms. He has more than 30 years of experience in the banking and mortgage industries.

Tag: Coronavirus

CoreLogic Reports 26.3% Decrease in Mortgage Fraud Risk

CoreLogic, Irvine, Calif., reported a 26.3% year-over-year decrease in fraud risk at the end of the second quarter, the second year of substantial decreases in risk.

Rob Wiggins: 20 Years of Mortgage–A Look Back

The past 20 years in the mortgage industry have been full of change, innovation and most importantly, lessons to be learned. Even in just the past few months, mortgage lenders have had to completely transform their business processes in the wake of the COVID-19 crisis. As the industry continues to prepare for what’s next, it’s important to take a look back at how far the industry has actually come.

Record-Low Rates Spur Increase in MBA Weekly Applications Survey

With the 30-year fixed mortgage rate sitting smack on 3 percent, mortgage seekers got the message, sparking an increase in mortgage applications last week, the Mortgage Bankers Association reported Wednesday.

Record-Low Rates Spur Increase in MBA Weekly Applications Survey

With the 30-year fixed mortgage rate sitting smack on 3 percent, mortgage seekers got the message, sparking an increase in mortgage applications last week, the Mortgage Bankers Association reported this morning.

COVID-Weary Consumers Feeling Less Confident

The Conference Board, New York, said its Consumer Confidence Index declined slightly in October, following a sharp September increase.

Rob Wiggins: 20 Years of Mortgage–A Look Back

The past 20 years in the mortgage industry have been full of change, innovation and most importantly, lessons to be learned. Even in just the past few months, mortgage lenders have had to completely transform their business processes in the wake of the COVID-19 crisis. As the industry continues to prepare for what’s next, it’s important to take a look back at how far the industry has actually come.

Reimagining Office While Working from Home

How companies and their workforces will use office going forward is an increasingly popular subject in 2020. There are questions around existing buildings and how landlord business plans and those of their lenders will perform.

Christy Moss, CMB, and Ken Logan, CMB: Reps and Warrants Relief Key to IMB Liquidity Strategies

There is more to spinning today’s volume into gold than efficiently originating high quality loans. For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.

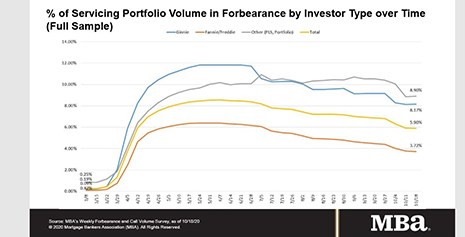

MBA: Share of Mortgage Loans in Forbearance Dips Slightly to 5.90%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.