CoreLogic Reports 26.3% Decrease in Mortgage Fraud Risk

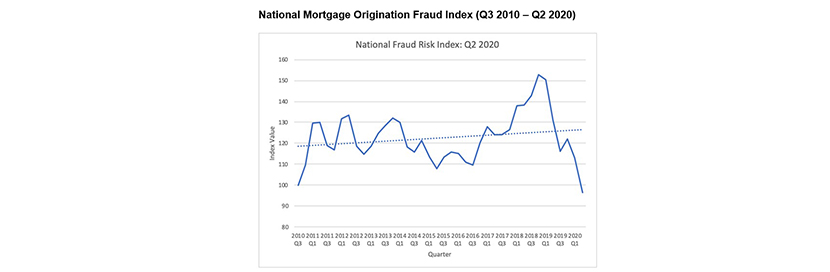

CoreLogic, Irvine, Calif., reported a 26.3% year-over-year decrease in fraud risk at the end of the second quarter, the second year of substantial decreases in risk.

The company’s quarterly Mortgage Fraud Report said through the second quarter, one in 164 mortgage applications, or 0.6% of all applications, contained indications of fraud, compared to the reported one in 123 mortgages, or 0.8%, a year ago.

Bridget Berg, Principal of Fraud Solutions Strategy for CoreLogic, said continued low mortgage rates and a record volume of refinances pushed the overall fraud risk down. However, she noted risk in the purchase segment increased by 6%, with investment properties driving the highest risk in both purchase and refinance populations.

“The large drop in fraud risk in the past year was primarily driven by record-high refinancing, which is traditionally lower risk transactions,” Berg said. “However, we still see elevated levels of risk in purchase transactions, and we have not yet seen the long-term impacts of the COVID-19 pandemic, so it’s imperative risk managers remain vigilant in searching out potential fraud.”

Other key report findings:

–Occupancy fraud risk was the only fraud type segment to experience an increase year over year, jumping 25.8% between Q2 2019 and Q2 2020

–New York, Nevada and Florida led states with the largest amount of mortgage application fraud risk. Nevada moved into the top three for the first time since 2014, showing a risk increase of 8% year-over-year.

–Nevada was also the only state in the top five that showed increased risk when compared to 2019.

–States with the greatest year-over-year risk growth include New Hampshire, Wyoming, North Dakota, Nevada and Rhode Island. Lower-populated states tend to show greater volatility due to less lending activity.

The report can be accessed at www.corelogic.com/mortgagefraudreport.