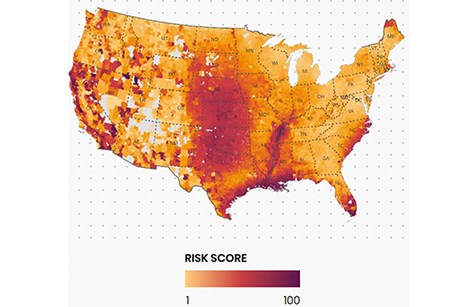

When you include the word “catastrophe” in the headline of a report, it tends to get attention. And CoreLogic, Irvine, Calif., says “catastrophe” plays an ominous role in the present and future housing environments.

Tag: CoreLogic

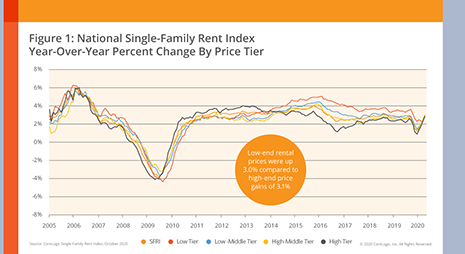

SFR Rebound: Single-Family Rent Growth Exceeds Pre-Pandemic Rates

CoreLogic, Irvine, Calif., said single-family rent growth reached 3.7 percent in November, the highest annual growth seen since June 2016.

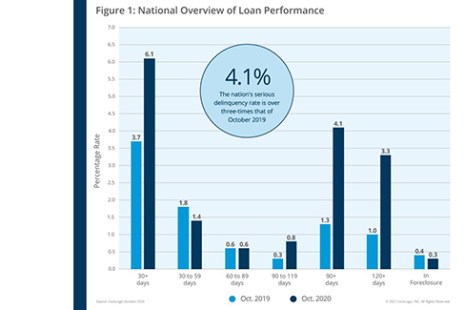

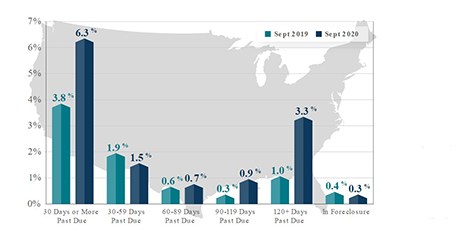

CoreLogic: Mortgage Delinquencies Rise, But Pace Moderates

CoreLogic, Irvine, Calif., said on a national level, 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in October, a 2.4-percentage point increase from a year ago, when it was 3.7%.

Industry Briefs Dec. 21, 2020

New American Funding, Tustin, Calif., launched a mentorship program to help team members develop professionally. New American Funding’s “360 Mentorship Program” matches an internal leader with another employee who is pursuing career advancement.

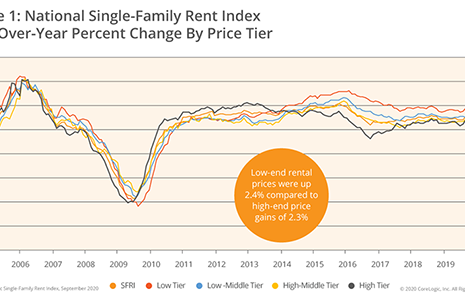

Single-Family Rental Market Stabilizes

CoreLogic, Irvine, Calif., said single-family rent growth increased in October, outpacing their previous-year growth rate for the first time since the pandemic started.

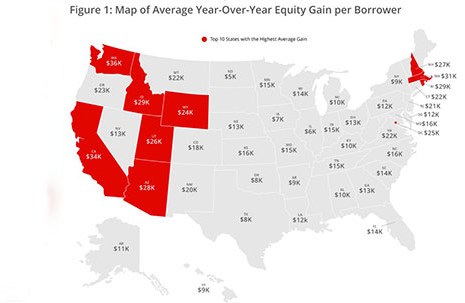

Home Equity Reaches Record High: Homeowners Gained $1 Trillion in 3Q Equity

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 10.8% year over year in the third quarter—a collective equity gain of $1 trillion and an average gain of $17,000 per homeowner.

CoreLogic: Serious Delinquencies Level Off in ‘Positive Signal’

CoreLogic, Irvine, Calif., said its monthly Loan Performance Insights Report for September showed a leveling off of serious loan delinquencies, a “positive signal” that the housing finance industry is thus far adjusting to the pandemic-induced economic downturn.

Absent Inventories, Home Prices Continue to Soar

November saw no letup in the S&P CoreLogic Case-Shiller Home Price Indices, with home prices nationwide jumping by 7 percent annually. And the Federal Housing Finance Agency said it was even more, rising by nearly 8 percent.

Single-Family Rents Bounce Back

CoreLogic, Irvine, Calif., said single-family rent growth gained strength in September but remain below pre-pandemic rates.

CoreLogic: Foreclosures Remain Low; Serious Delinquencies Continue to Build Up

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.