CoreLogic: Catastrophes Illustrate Impact of Climate Change on Housing

When you include the word “catastrophe” in the headline of a report, it tends to get attention. And CoreLogic, Irvine, Calif., says “catastrophe” plays an ominous role in the present and future housing environments.

The company’s 2020 Catastrophe Report noted 2020 marked the sixth consecutive year with more than 10 weather events surpassing $1 billion in losses, including hurricanes, tornadoes, floods and wildfires.

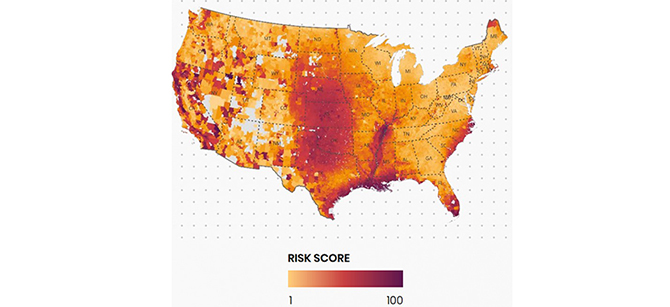

More ominously, the report’s combined peril risk scores show 35 million homes—nearly one-third of the U.S. housing stock—are exposed to high risk from natural hazards. The highest risk homes are in California, Texas, Oklahoma, Kansas, Nebraska, along the Mississippi River and large stretches of the Gulf and Atlantic coasts.

“We can no longer ignore the impact of climate change on the housing economy,” the report said. “The U.S. is exposed to many natural hazards: Hurricanes bring devastating winds, storm surge and inland flooding to coastal locations. Severe convective storms bring damaging tornadoes, hailstorms and derechos to a great portion of the country. Earthquakes, wildfires and seasonal flooding combine to produce risks that persist throughout the U.S.”

For the mortgage and financial services industries, natural hazards affect all areas of the housing economy and property ecosystem,” CoreLogic said. “When disaster strikes, homes and businesses can be damaged or destroyed, leaving a trail of devastation in its wake,” the report said. “This results in a drop in vacancy rates, an increase in delinquencies, a local economic recovery and increased demand for resources — all during a recovery period involving aid and reconstruction of at least several months.”

The report urged the insurance and mortgage industries to leverage new technologies to increase efficiency, reduce risk and ensure protection of American homeownership and commercial assets. “By leveraging catastrophe risk science, weather verification tools and digital workflows, insurers and mortgage lenders can better understand peril risk and damages down to a parcel level,” the report said.