SFR Rebound: Single-Family Rent Growth Exceeds Pre-Pandemic Rates

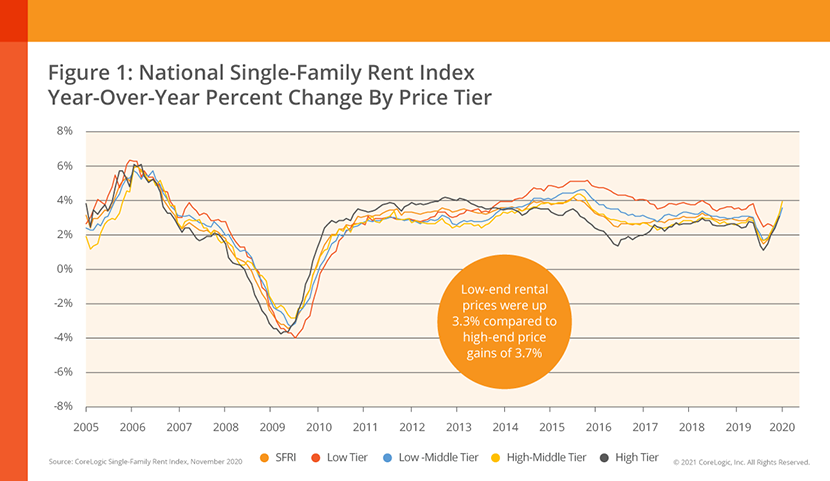

CoreLogic, Irvine, Calif., said single-family rent growth reached 3.7 percent in November, the highest annual growth seen since June 2016.

The firm’s Single-Family Rent Index said annual rent growth slowed in the pandemic’s early months but has picked up since last June.

“Rent increases for single-family properties rebounded in recent months and in November exceeded the pre-pandemic rate,” said CoreLogic Principal Economist Molly Boesel. “This is in contrast to rents for multifamily properties, which have decreased as tenant preferences shifted away from high-density apartment buildings to low-density, single-family homes.”

JLL, Chicago, said single-family rentals are capturing more investor interest during the pandemic. “More investors and developers are turning their attention to the asset class,” said JLL Senior Director Zach Nolan.

Some institutional SFR investors see the sector as an opportunity to get ahead of a long-term trend. JLL reported institutional owners–those who own more than 100 homes–comprise less than 3 percent of total inventory, giving new entrants ample opportunity for growth in this sector.

“Demand for less-dense environments, more space for work and school and a desire for the ‘lock-and-leave’ lifestyle support substantial demand for single-family rental homes,” said JLL Senior Director Matthew Putterman. “Since the Great Financial Crisis, the adoption of new management and leasing technologies has enabled investors and operators to aggregate substantial portfolios in ways that didn’t previously exist.”

As more people have established themselves in rental homes, single-family rental housing has seen lower turnover rates than traditional rental multifamily housing, in part because SFR residents prefer a single-family house’s extra space and garage for living and storage. “[This] has helped support the low turnover and strong rent growth investors are seeking,” said JLL Managing Director Chris Shea.

Last year the rental vacancy rate on one-unit homes fell to its lowest level since 1994, contributing to rent price increases, CoreLogic reported. “While single-family inventories fell at all price tiers, the lowest-priced rentals fell the least, which is reflected in its underperformance compared to other price levels,” the SFRI report said. “Rent price growth among lower-priced rentals has lagged for most of the pandemic, and in November, remains the only tier to trail last year’s levels.”

But the recent uptick in employment growth helped lower-priced SFR assets trend toward a recovery in the fall, CoreLogic said. Rent price growth again drew close to its year-before levels. “Should these factors hold, we may expect to see low-end rent price growth return to pre-pandemic levels like the other tiers,” the report said.