AREAL.ai, Los Angeles, released the Closing Disclosure Balancer Automation Tool, an AI-powered platform that allows lenders and their title agency partners to compare and balance Closing Disclosures to remain in full compliance with the CFPB’s TRID rules.

Tag: CoreLogic

Single-Family Rent Growth Declines for 10th Straight Month

CoreLogic, Irvine, Calif., said single-family rent price growth continued its slowing trend in February as it dropped to a 5% growth rate.

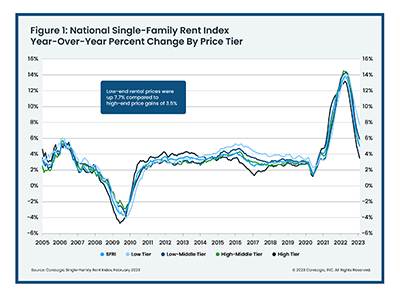

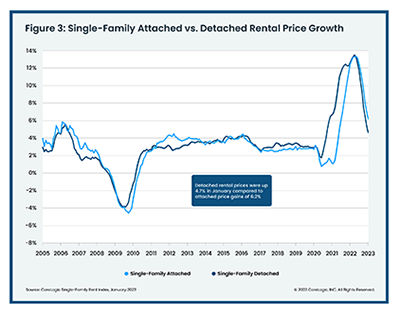

CoreLogic: Single-Family Rent Growth Slows to Nearly Two-Year Low

CoreLogic, Irvine, Calif., reported U.S. annual single-family rent growth continued to slow year-over-year in January, declining for the ninth straight month to 5.7%.

Industry Briefs Feb. 27, 2023: CoreLogic Acquires Roostify

CoreLogic, Irvine, Calif., a global property information, analytics and data-enabled services provider, acquired Roostify, San Francisco, a digital mortgage technology provider.

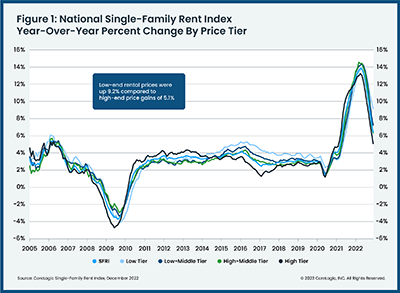

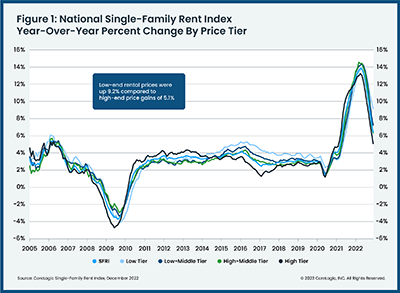

CoreLogic: December Single-Family Rent Price Growth Drops by Nearly Half

CoreLogic, Irvine, Calif., reported U.S. single-family rent price gains slowed in December for the eighth straight month on an annual basis.

CoreLogic: December Single-Family Rent Price Growth Drops by Nearly Half

CoreLogic, Irvine, Calif., reported U.S. single-family rent price gains slowed in December for the eighth straight month on an annual basis.

Industry Briefs Jan. 31, 2023: Revolution Mortgage Partners with Silverwork Solutions

Silverwork Solutions, Chicago, a developer of digital workforce BOTs, announced a partnership with Revolution Mortgage, Columbus, Ohio.

Mortgage Performance Remains ‘Exceptionally Healthy’

Reports this week from CoreLogic, Irvine, Calif., and Black Knight, Jacksonville, Fla., as well as Monday’s Loan Monitoring Report from the Mortgage Bankers Association, show mortgage performance in the post-pandemic era remains strong and healthy.

CoreLogic: Single-Family Rent Growth Falls 7th Straight Month

CoreLogic, Irvine, Calif., reported U.S. single-family rent growth slowed for the seventh consecutive month in November but said growth remains positive.

Housing Market Roundup Jan. 10, 2023

Here’s a summary of recent housing/economics articles that came across the MBA NewsLink desk: