CoreLogic: December Single-Family Rent Price Growth Drops by Nearly Half

CoreLogic, Irvine, Calif., reported U.S. single-family rent price gains slowed in December for the eighth straight month on an annual basis.

But the 6.4% national increase remained higher than pre-pandemic levels, CoreLogic said in its Single-Family Rent Index report.

“Although major tech company layoffs are making headlines, a still relatively healthy U.S. job market is keeping rent prices elevated, with the national unemployment rate hovering near a decade low in December,” the report said. “The job market’s impact on rental price growth has been particularly evident in cities like Miami, which led the country for annual increases throughout most of 2022.” Miami’s unemployment rate equaled 1.6% in December, the lowest of the 20 metros CoreLogic studied.

Molly Boesel, Principal Economist with CoreLogic, noted U.S. single-family rental price growth closed out 2022 at about half of what it was one year ago. “However, while rent growth has been slowing, it still rose at more than double the pre-pandemic rate,” she said. “Rental price gains began increasing near the end of 2020 and have risen by about an average of $300 in the past two years.”

Boesel noted she expects annual single-family rent growth will slow throughout 2023, “but it will likely not decline to the extent it did during the height of the pandemic,” she said.

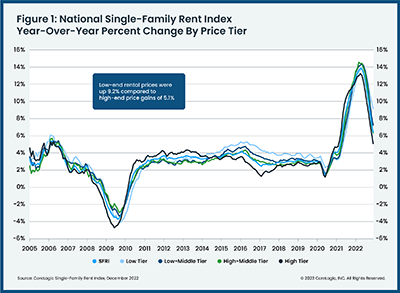

CoreLogic examined four tiers of single-family rental prices. National SFR growth across the four tiers, and the year-over-year changes, equaled:

• Lower-priced (75% or less than the regional median): 9.2%, down from 11.3% in December 2021

• Lower-middle priced (75% to 100% of the regional median): 7.2%, down from 12.5% in December 2021

• Higher-middle priced (100% to 125% of the regional median): 6.3%, down from 12.5% in December 2021

• Higher-priced (125% or more than the regional median): 5.1%, down from 11.9% in December 2021

CoreLogic said differences in rent growth by property type emerged after COVID-19 took hold as renters sought standalone properties in lower-density areas. “This trend drove an uptick in rent growth for detached rentals in 2021, while the gains for attached rentals were more moderate,” the report said. “As single-family rent prices continued growing rapidly, preferences for attached rentals began to emerge in early 2022, and by summer, they had higher increases than detached properties.”