CoreLogic: Single-Family Rent Growth Slows to Nearly Two-Year Low

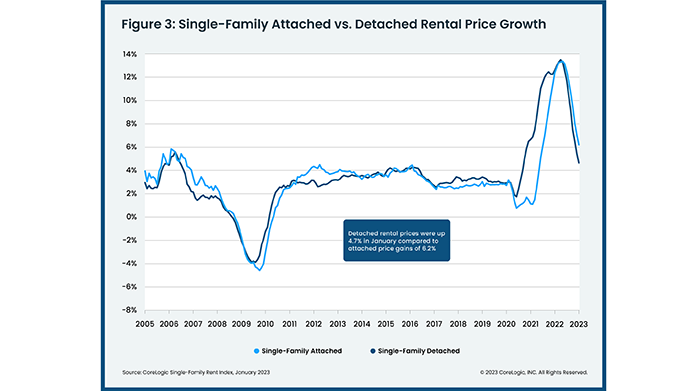

CoreLogic, Irvine, Calif., reported U.S. annual single-family rent growth continued to slow year-over-year in January, declining for the ninth straight month to 5.7%.

“January’s single-family rent growth cooled to the lowest level since the spring of 2021,” said Molly Boesel, Principal Economist with CoreLogic. “While rent growth is slowing at all tracked price tiers, declines for the lowest-cost rentals are not as significant, which raises affordability concerns.”

Boesel noted annual rent growth for lower-tier properties was about three times the pre-pandemic rate, while gains in the highest tier were nearly one-and-a-half times during the same period.

The CoreLogic Single-Family Rent Index said national single-family rent growth across those tiers were:

• Lower-priced (75% or less than the regional median): 8.5%, down from 12.1% in January 2022

• Lower-middle priced (75% to 100% of the regional median): 6.5%, down from 13.3% in January 2022

• Higher-middle priced (100% to 125% of the regional median): 5.5%, down from 13.5% in January 2022

• Higher-priced (125% or more than the regional median): 4.3%, down from 12.4% in January 2022

Rent growth and gains in all four price tiers were higher in January than before the pandemic, CoreLogic said.

In a separate report, ATTOM, Irvine, Calif., calculated the average annual gross rental yield on three-bedroom properties (annualized gross rent income divided by purchase price) among 212 counties it analyzed will be 7.5% in 2023, up from a 6.7% average in 2022 and the first time since at least 2019 that the figure rose across the country.

“The broader housing market didn’t fare nearly as well in 2022 as it did in 2021,” said ATTOM CEO Rob Barber. “Prices finally hit the wall, at least temporarily. But that appears to be benefitting the growing number of investors around the U.S. who rent out single-family properties.

Barber said rents for single-family homes are growing while prices have flattened out, “which has helped boost yields for landlords for the first time in at least several years.”

The ATTOM Single-Family Rental Market report said counties with the highest potential annual gross rental yields this year include Indian River County, Fla. (15 percent); Collier County, Fla., (14.7 percent); Wayne County, Mich., (13 percent) and Mercer County, N.J. (12.7 percent).