Ahead of this Thursday’s National Delinquency Survey from the Mortgage Bankers Association, Corelogic, Irvine, Calif., reported November’s loan delinquency rates fell to levels last seen before the coronavirus pandemic.

Tag: CoreLogic Loan Performance Insights Report

CoreLogic: Mortgage Delinquencies at Pre-Pandemic Low

CoreLogic, Irvine, Calif., reported the nation’s overall delinquency rate declined for seventh consecutive month to its lowest level since the start of the coronavirus pandemic.

CoreLogic: Mortgage Delinquencies at Pre-Pandemic Low

CoreLogic, Irvine, Calif., reported the nation’s overall delinquency rate declined for seventh consecutive month to its lowest level since the start of the coronavirus pandemic.

Ahead of MBA Quarterly Survey, Reports Show Drop in Delinquencies, Rise in Foreclosures

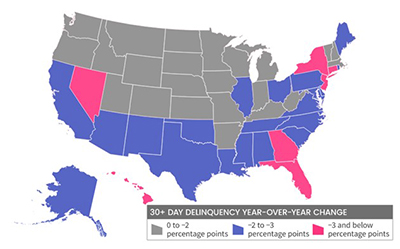

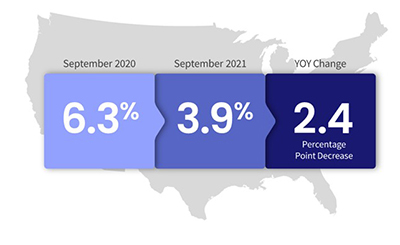

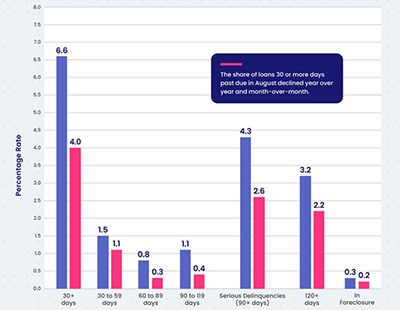

This morning, the Mortgage Bankers Association releases its 3rd Quarter National Delinquency Survey. Ahead of the report, CoreLogic, Irvine, Calif., reported steady drops in mortgage delinquencies in August, while ATTOM, Irvine, Calif., said the end of foreclosure moratoria earlier this summer is pushing mortgage foreclosure actions higher.

CoreLogic: June Foreclosure Inventory Rate Lowest in Two Decades

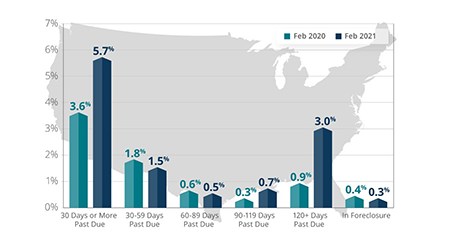

CoreLogic, Irvine, Calif., said 4.4% of all mortgages in the U.S. were in some stage of delinquency in June, a 2.7-percentage point decrease in delinquency from a year ago but above the February 2020 pre-pandemic rate of 3.6%.

CoreLogic: Strong Improvement in U.S. Mortgage Delinquency Rates

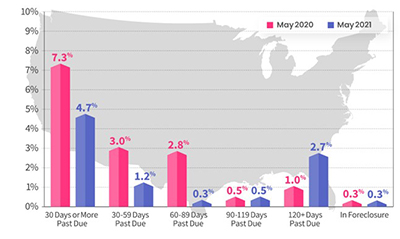

CoreLogic, Irvine, Calif., said just 4.9 percent of all mortgages in the U.S. were in some stage of delinquency, the lowest rate in more than a year.

CoreLogic: Annual Mortgage Delinquency Rate Drops for 5th Straight Month to 10-Month Low

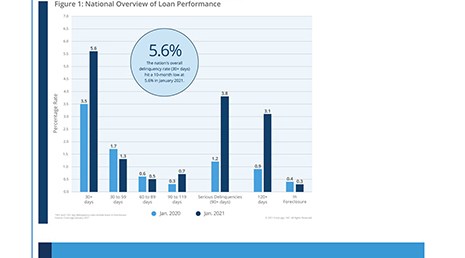

CoreLogic, Irvine, Calif., said while mortgage delinquencies rose month over month in January, overall delinquency rates fell for the fifth straight month to the lowest level since last March.