Commercial real estate executives are growing “bearish” about the U.S. CRE market, DLA Piper’s Global Real Estate State of the Market Survey reported yesterday.

Tag: Commercial Real Estate

Reimagining Office While Working from Home

How companies and their workforces will use office going forward is an increasingly popular subject in 2020. There are questions around existing buildings and how landlord business plans and those of their lenders will perform.

Reimagining Office While Working from Home

How companies and their workforces will use office going forward is an increasingly popular subject in 2020. There are questions around existing buildings and how landlord business plans and those of their lenders will perform.

Along Came COVID: Emerging Tech Trends in Commercial Real Estate Finance

Emerging technologies and start-up firms proliferated in commercial real estate over the last several years. With the conventional wisdom being that while the single-family real estate finance industry has embraced new technologies and innovation, CRE was a laggard and therein lies a massive opportunity.

Fitch: Secular Shifts Force U.S. Commercial Real Estate to Adapt

Fitch Ratings, New York/London, said post-pandemic, many U.S. commercial real estate segments will be transformed by the way space is used, which will have long-term consequences for property performance and financeability.

Atlanta Fed’s Brian Bailey, CRE, Dishes on Commercial Real Estate Risks

With just under two decades wearing different hats in the commercial real estate industry before joining the bank, Bailey is a CRE subject matter expert in the Atlanta Fed’s Supervision, Regulation and Credit division. In addition to previous roles as an appraiser, consultant and property developer, Bailey holds CCIM and CRE designations. MBS Newslink interviewed Bailey to get his perspective on the current environment.

Atlanta Fed’s Brian Bailey, CRE, Dishes on Commercial Real Estate Risks

With just under two decades wearing different hats in the commercial real estate industry before joining the bank, Bailey is a CRE subject matter expert in the Atlanta Fed’s Supervision, Regulation and Credit division. In addition to previous roles as an appraiser, consultant and property developer, Bailey holds CCIM and CRE designations. MBS Newslink interviewed Bailey to get his perspective on the current environment.

Atlanta Fed’s Brian Bailey, CRE, Dishes on Commercial Real Estate Risks

With just under two decades wearing different hats in the commercial real estate industry before joining the bank, Bailey is a CRE subject matter expert in the Atlanta Fed’s Supervision, Regulation and Credit division. In addition to previous roles as an appraiser, consultant and property developer, Bailey holds CCIM and CRE designations. MBS Newslink interviewed Bailey to get his perspective on the current environment.

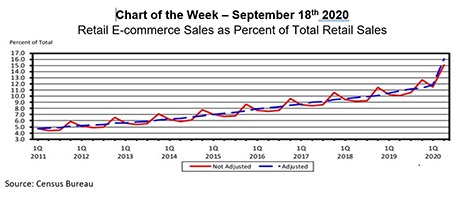

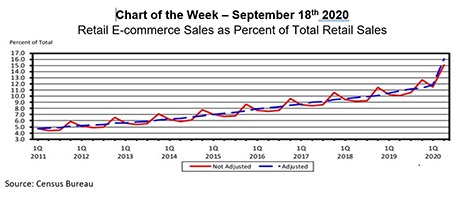

MBA Chart of the Week: Retail E-Commerce/Retail Sales

Even before the onset of the pandemic, retail properties were under the microscope. Practitioners spoke about the United States being “over-retailed” compared to other countries, about a shift to experiential retail with a focus on services rather than goods, and about how the rise in e-commerce is a challenge to bricks-and-mortar.

MBA Chart of the Week: Retail E-Commerce/Retail Sales

Even before the onset of the pandemic, retail properties were under the microscope. Practitioners spoke about the United States being “over-retailed” compared to other countries, about a shift to experiential retail with a focus on services rather than goods, and about how the rise in e-commerce is a challenge to bricks-and-mortar.