Atlanta Fed’s Brian Bailey, CRE, Dishes on Commercial Real Estate Risks

Andrew Foster afoster@mba.org

A Change Will Do You Good. At least that was the theme from the 1996 hit by Sheryl Crow. However, change for a multi-billion industry can be challenging, and the word itself has now become a troubling reminder to many in the CRE and lending industries, as COVID stalled the economy in 2020, accelerated disruption and risk in the critical CRE and Finance industry and caused a shortage of the change that jingles in your pocket.

Lending to owners and developers of offices, apartments, shopping centers, and industrial properties is critical for financial institutions and faces some headwinds as evidenced by a slew of second quarter 2020 bank earnings announcements in which reserve estimates for commercial real estate loan portfolios featured prominently.

Clearly, to Federal Reserve banking supervisors who are charged with ensuring the safety and soundness of financial institutions, monitoring the health of commercial real estate is significant and no less so in a recession. Brian Bailey, CRE, is central to that work.

With just under two decades wearing different hats in the commercial real estate industry before joining the bank, Bailey is a CRE subject matter expert in the Atlanta Fed’s Supervision, Regulation and Credit division. In addition to previous roles as an appraiser, consultant and property developer, Bailey holds CCIM and CRE designations. MBS Newslink interviewed Bailey to get his perspective on the current environment.

Thoughts and opinions expressed in this article are not necessarily those of the Federal Reserve Bank of Atlanta, or the Federal Reserve System.

MBA NEWSLINK: MBA reports banks as the largest investor type for commercial mortgage lending. What is current exposure to commercial real estate for bank balance sheets? What are some of the typical challenges?

BRIAN BAILEY: Banks are one of the largest lenders, in part due to their close ties to the community. According to 2Q2020 Call Report data, Banks have roughly $2.2 trillion in commercial real estate loans on their balance sheets. Other (which includes investor properties owned for lease) represents $920 billion, owner-occupied at $534 billion and $406 billion for multifamily. Commercial construction and development (C&D) loans are those that may have more risk associated accounts for roughly $358 billion in outstanding balances. At this point in the economic cycle, C&D loans require more monitoring due to the changes in market conditions; however, banks have generally been more prudent with terms, partially due to the overly long length of the expansion. While $358 billion is a significant amount, it is much lower than the early 2008 level, which was $562 billion.

Markets run the spectrum from lower-barrier, easy to enter markets, to higher-barrier markets, where it is challenging to build. Lower-barrier to entry, high-growth markets, such as Atlanta, Charlotte, Dallas, Jacksonville, Nashville, Phoenix, Salt Lake City and Tampa may represent an enhanced risk as market conditions may decline rapidly. Some markets, including New York, Chicago, Los Angeles, Seattle and south Florida, have unique challenges. On one hand, these areas generally have a higher barrier to entry, making it more challenging to build. On the other hand, rapid inflows and outflows of foreign capital can create distortions for property values and the associated underwriting in such areas. The pandemic has created a new set of challenges as the need for social distancing has resulted in a surge in relocations from highly dense urban areas.

NEWSLINK: Right out of the gates of this downturn, the industry has focused on challenges with retail and hospitality properties. What are some of the current impediments to lending?

BAILEY: The pandemic and the associated shelter-in-place orders have had significant effects on the airline, hospitality and retail sectors. We can look to public information available in the commercial mortgage-backed securities market to show the disruption to borrower businesses that has taken place due to the pandemic.

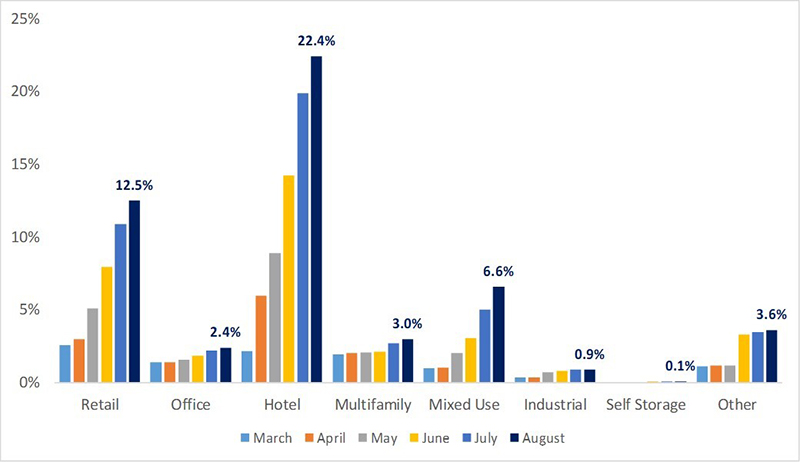

The chart below shows loans that have been transferred to special servicing. A vast majority (95%+), have been transferred due to non-payment. Delinquency rates have been increasing since April. Currently, hotel and retail lead the way with 22.4 percent and 12.5 percent of loans, respectively, transferred to special servicing. Most of the hotels are receiving modifications to allow the use of reserves, intended for furniture, fixtures and equipment, to make payments and stay current on their loans. However, there are questions in the industry regarding how long hotels can use FFE reserves to remain current on their loans. Since funds intended for use on FFE are currently being repurposed, this dynamic will also impact spending on FFE for years to come.

Luxury and upscale hotels remain a significant distance from breakeven; however, the point appears closer for lower-price hotels. Hotels that have a seasonality component to their business may be financially challenged for an extended period of time. For example, many hotels in tourist destinations were closed or operated at a reduced capacity during April and May, the traditional spring break period, when occupancies are usually close to 100% and rates are typically 30%-70% higher than the annual average.

Mixed-use properties have performed very well over the past decade. However, mixed-use loans are also encountering increased duress as transfers to special servicing have risen to 6.6%. A portion of the stress is driven by the vast closures associated with restaurant and retail businesses. Stress has been further exacerbated by various eviction moratoriums on multifamily property.

CMBS Percent of Loans Transferred to Special Servicing (%)

The banking and lending industry remains in the process of evaluating and assessing the borrower implications associated with COVID. Once the pandemic hit, many bank lenders provided a 90-day forbearance period. At the end of the 90 days, depending on the property and borrower, a lender might opt to provide another 90-day term with a deeper-dive into the cash flows and assistance from the borrower on terms. After the second 90-day term expires, that group will most likely utilize a longer-term solution due to the TDR (Temporary Debt Restructuring) provision included in the CARES Act. The group that did not receive an additional 90-day forbearance received a more permanent solution after the expiration of the first 90-day term. Both strategies provided borrower’s with flexibility and allowed time to adjust to the market conditions associated with the underlying property.

One of the most significant CRE issues arising from the pandemic is asset valuation. Due to the economic slowdown and significant decline in lease and sales transactions, it is difficult to find current data to support appraisals compared to pre-COVID conditions. This issue has been exacerbated due to the significant number of business closures and inconsistencies in reopening. Public CMBS pools are beginning to receive new valuations. In several instances, value in the hotel space is down 12%-46%. While this represents a handful of valuations, it appears that Full-service, higher-priced hotels are experiencing the biggest declines in valuation. Because of the uncertainty around reopening, the return of travel, and the availability of a vaccine, stress testing valuation assumptions and appraisal results is a sound risk management practice.

NEWSLINK: How are you viewing potential for challenges in office and multifamily property markets which so far seem to have held up their performance relatively well?

BAILEY: The challenges to office and multifamily property markets are markedly different. Let’s start with multifamily. There has been some overbuilding concentrated in a few neighborhoods; however, as a whole, the nation has a shortfall, and needs a significant amount of affordable housing which mid-to-lower-end apartments provide. In my view, the issues that are associated with declining occupancy rates in multifamily are essentially driven by economic downturn and the heightened rate of unemployment.

FOMC policymakers have indicated that they are extremely focused on getting folks back to work, and may let the inflation rate reasonably go beyond the target in favor of bringing down unemployment. In the short-run, I suspect that there will be some contraction in the number of renters as a segment will return home. According to the Pew Research Center analysis of monthly Census Bureau data, a majority of young adults in the U.S. live with their parents for the first time since Great Depression. However, housing supply is very limited and I do not see a contraction in the number of folks in the renter pool as a long-term dynamic.

As far as office, the pandemic has accelerated the use of telecommuting, which was already picking up speed prior to the arrival of COVID-19. According to several surveys, workers like the flexibility of remote work. Employers/businesses are always on the lookout for non-monetary benefits. It is my view that this is one of them. I believe that workers who were in the office five days a week pre-COVID, may now be onsite for fewer days a week. Essentially, the trend of being more efficient with the use of space will continue. However, there are several dynamics that counter a reduction in demand for office space. First, while densification has been a huge trend, this will probably cease as workers want more space for social distancing to reduce the risk of COVID. Second, businesses will probably need more swing space to accommodate workers who need to be onsite due to last minute demands. Third, the population continues to grow, which will most likely translate into more office workers that need more space. My view is that the shift in office will be at more glacial pace and will be mitigated in the short term by the longer-term structure of office leases.

NEWSLINK: What’s top of mind for examiners in this unprecedented commercial real estate environment?

BAILEY: Safety and soundness is always top of mind! Certainly, COVID created some unique dynamics which required us to adjust our processes. The Federal Reserve implemented several programs to stabilize the markets and maintain liquidity. In March, the Board also announced that it would focus on outreach and monitoring in light of the coronavirus response measures and temporarily reduce its exam activity to allow banks to implement contingency operating plans and adapt their operations. On June 15, the Board announced it would resume regular exam activity. Our initial focus has been on assessing higher risk banks, particularly those with credit concentrations in higher risk or stressed industries. As always, we also remain focused on consumer protections, access to credit and fair treatment.

There are a number of other issues that have significant regulatory implications, including the transition from LIBOR and CECL adoption. Additionally, as the industry has identified, rapid change is occurring in the CRE space and there will be some assets that are greatly impacted. We continue to closely monitor the conditions and the implications for future lending.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)