As the anniversary of COVID significantly impacting the U.S. and commercial/multifamily property markets passes, challenging questions about property values remain top of mind.

Tag: Commercial Real Estate

Troubled Commercial Mortgage Loan Triage: A Special Servicer Roundtable

With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with a special servicer, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.

Troubled Commercial Mortgage Loan Triage: A Special Servicer Roundtable

With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with a special servicer, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.

CRE & Lodging Landscapes Post-COVID: Conversation with JLL’s Ryan Severino, Michael Huth

MBA’s Andrew Foster recently spoke with Ryan Severino and Michael Huth of JLL on the outlook for commercial real estate and in particular, the hotel/lodging sector in a post-coronavirus environment.

CRE & Lodging Landscapes Post-COVID: Conversation with JLL’s Ryan Severino, Michael Huth

MBA’s Andrew Foster recently spoke with Ryan Severino and Michael Huth of JLL on the outlook for commercial real estate and in particular, the hotel/lodging sector in a post-coronavirus environment.

Insurance Quotes and Coverages: Hardening Insurance Market and Lender Implications

One of the many shifts occurring in the commercial real estate marketplace are evolving dynamics for insurance coverages and costs which help mitigate landlord and lender risks. These shifts impact existing borrowers and loans as well as new originations and all the different parties involved in the CRE finance ecosystem.

Lenders Adapting to New Market Dynamics

Marcus & Millichap, Calabasas, Calif., said the commercial real estate lending landscape has improved from the pandemic’s early days, when lenders and investors paused to assess the coronavirus’s impact.

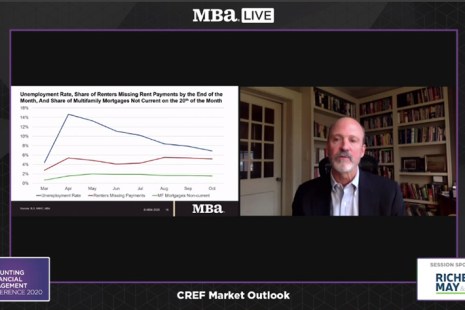

CREF Market Outlook: Commercial Real Estate’s Four-Bucket Theory

The pandemic has affected different commercial property types in very different ways, and they will likely perform differently when the economy bounces back, said MBA Vice President of Commercial Real Estate Research Jamie Woodwell.

COVID Upends CBD Real Estate

The COVID pandemic is wreaking havoc on commercial and residential real estate, especially in central business districts, said Wells Fargo Securities, Charlotte, N.C.

Reimagining Office While Working from Home

How companies and their workforces will use office going forward is an increasingly popular subject in 2020. There are questions around existing buildings and how landlord business plans and those of their lenders will perform.