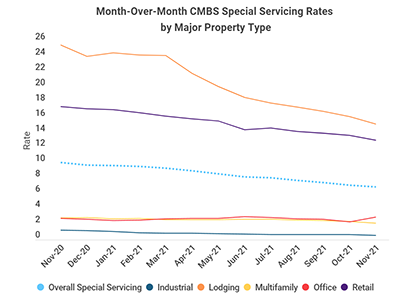

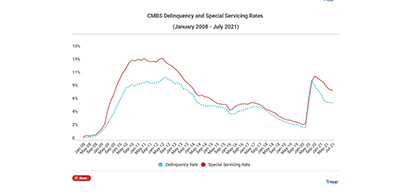

Trepp, New York, reported both the commercial mortgage-backed securities delinquency rate and special servicing rate dropped in November.

Tag: CMBS

Sneak Peak: KBRA Analysts Look to 2022 Commercial Mortgage-Backed Securities Sector

Kroll Bond Rating Agency, New York, just released its 2022 Sector Outlook—CMBS: Full Steam Ahead report. MBA NewsLink interviewed KBRA’s Larry Kay and Patrick McQuinn to get their insights on the current lending environment and property fundamentals as well as factors that may affect property performance in 2022.

September CMBS Delinquency, Special Servicing Rates Drop

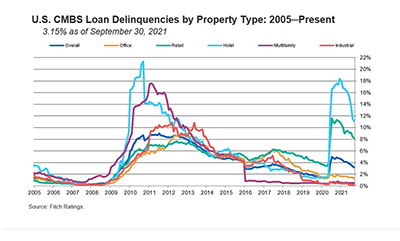

Fitch Ratings, New York, and Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate continued it steady fall in September.

CMBS Delinquency Rate Shrinks, Cumulative Default Rate Increases

The commercial mortgage-backed securities delinquency rate continues to shrink, but the cumulative loan default rate increased slightly in first-half 2021, according to two new reports from S&P Global Ratings and Fitch Ratings.

CMBS Delinquency Rate Drops Sharply

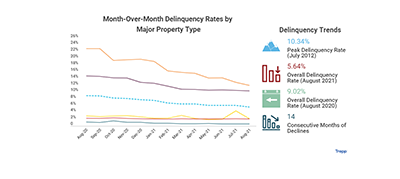

The commercial mortgage-backed securities delinquency rate declined sharply in August, posting the largest drop in six months, reported Trepp LLC, New York.

MBA CMBS Trends and Topics Webinar Series Starts Oct. 7

Join MBA’s CMBS Committee and industry experts for a three-part webinar series exploring the latest trends and hot topics in commercial real estate finance, including agency and private-label securitization activities …

CMBS Delinquency, Special Servicing Rates Dip Again

“More of the same” was the commercial mortgage-backed securities delinquency rate headline in July, according to Trepp Senior Managing Director Manus Clancy.

Fitch Ratings: Environmental Factors Can Affect CMBS Large Loan Ratings

Fitch Ratings, New York, said a property’s environmental impact and sustainability may influence commercial mortgage-backed securities bond ratings in single-asset single-borrower and large-loan transactions.

Fitch Ratings: Environmental Factors Can Affect CMBS Large Loan Ratings

Fitch Ratings, New York, said a property’s environmental impact and sustainability may influence commercial mortgage-backed securities bond ratings in single-asset single-borrower and large-loan transactions.

Fitch Ratings: Environmental Factors Can Affect CMBS Large Loan Ratings

Fitch Ratings, New York, said a property’s environmental impact and sustainability may influence commercial mortgage-backed securities bond ratings in single-asset single-borrower and large-loan transactions.