In the first quarter of 2025, U.S. house prices increased 4% compared to the first quarter of 2024, as reported by the Federal Housing Finance Agency.

Tag: Chart of the Week

Chart of the Week: IMB Pre-Tax Net Production Income by Average Loan Balance in Q1 2025

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $28 on each loan they originated in the first quarter, according to MBA’s newly released Quarterly Mortgage Bankers Performance Report.

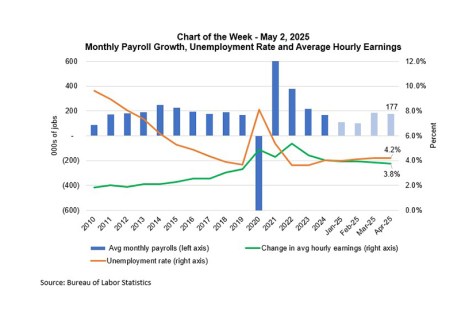

Chart of the Week: Monthly Payroll Growth, Unemployment Rate and Average Hourly Earnings

The April Employment Situation report showed that the job market continues to hold up.

MBA Chart of the Week: Annual Origination Dollar Volume

MBA’s April forecasts and commentary include some sizable updates from our March forecasts as we try to incorporate the net impact of the frequently changing tariff landscape.

Chart of the Week: Commercial and Multifamily Mortgage Debt Outstanding

According to MBA’s Quarterly Mortgage Debt Outstanding Report, total commercial and multifamily mortgage debt outstanding increased by 3.7% year-over-year, rising from $4.62 trillion in Q4 2023 to $4.79 trillion in Q4 2024. This growth reflects continued investment in commercial real estate, with sector-specific variations in debt allocation.

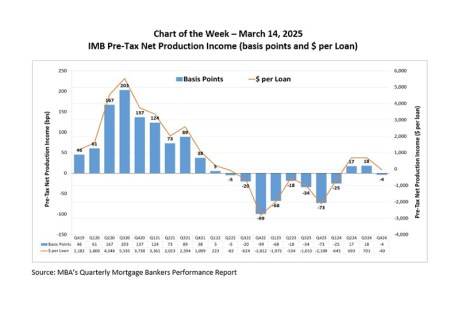

Chart of the Week: IMB Pre-Tax Net Production Income

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of 4 basis points in the fourth quarter, a decrease from the net profit of 18 basis points in the third quarter, MBA’s Quarterly Mortgage Bankers Performance Report found.

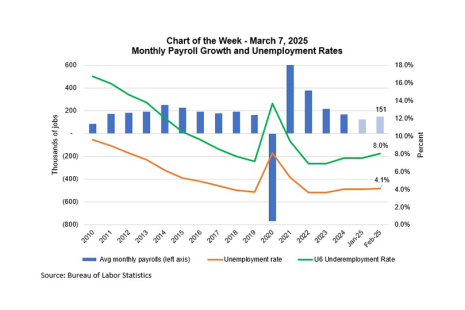

MBA Chart of the Week: Monthly Payroll Growth, Unemployment Rates

The job market softened somewhat in February, with the unemployment rate increasing to 4.1%, the pace of private sector job growth up by 140,000, and wage growth steady at 4%.

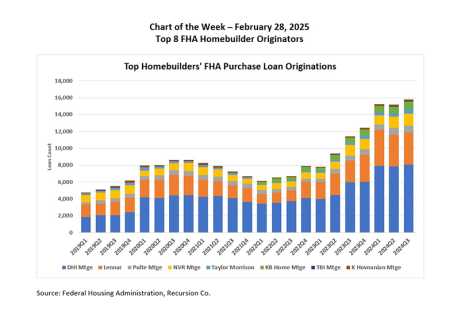

Chart of the Week: Top 8 FHA Homebuilder Originators

The headwinds facing mortgage transactions continued unabated in 2024 as home prices reached new record highs while the 30-year mortgage rate rose back over 7%. One sector that effectively dealt with these impediments was the homebuilders.

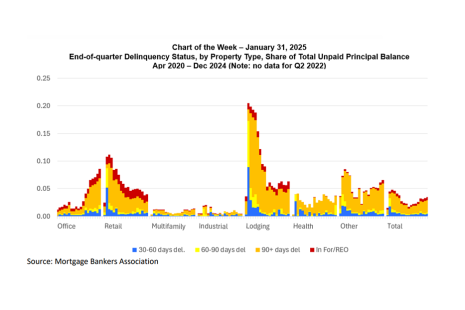

Chart of the Week: End-of-Quarter Delinquency Status, by Property Type, Share of Total Unpaid Principal Balance

Delinquency rates for commercial property mortgages increased in the fourth quarter, according to MBA’s latest CREF Loan Performance Survey.

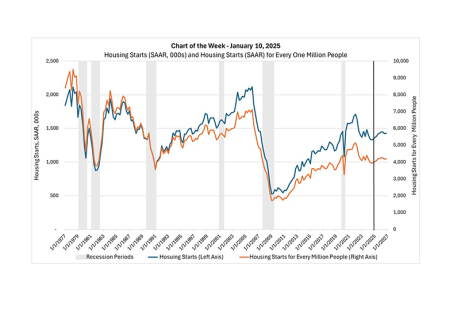

Chart of the Week: Housing Starts and Housing Starts for Every 1 Million People

In this week’s MBA Chart of the Week, we look at one statistic–aggregate single-family and multifamily housing starts–and examine how it has evolved since the start of the Carter Administration.