Life-science lab space has emerged as a coveted sector as hefty increases in funding and employment fuel both demand for and construction of lab space in leading U.S. life-science markets, reported CBRE, Dallas.

Tag: CBRE

Commercial, Multifamily Briefs from CBRE, Enterprise Community Partners

CBRE Group, Dallas, acquired Union Gaming, an investment bank and advisory firm focused on the global gaming sector.

Tech Hubs Poised For Growth After Holding Steady Through Pandemic

Technology employment weathered the pandemic better than most professions; now established tech capitals such as San Francisco and Seattle and emerging tech hubs including Dayton and Colorado Springs are poised for growth, said CBRE, Dallas.

CBRE: U.S. Needs 330M Square Feet of Distribution Space to Meet eCommerce Demand

CBRE, Dallas, estimated the U.S. will need an additional 330 million square feet of distribution space by 2025 just to handle projected increases in online ordering.

Dealmaker: CBRE Arranges $91M for San Diego Office Portfolio

CBRE, Dallas, arranged $91 million to refinance The Brookwood North San Diego Portfolio.

Fewer Firms Plan to Shrink Office Portfolios

U.S. companies have scaled back their plans to make big cuts to their office portfolios and many now expect their offices to support “collaborative” work in person rather than remotely, said CBRE, Dallas.

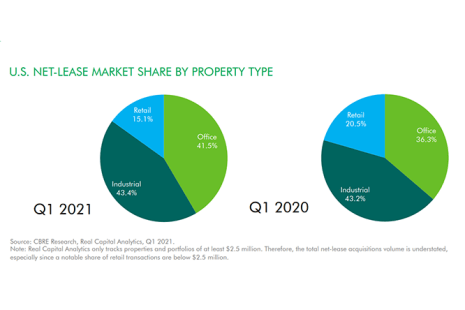

Net-Lease Investment Approaches Pre-Pandemic Levels

Investment in U.S. net-lease properties approached pre-pandemic levels in the first quarter, reported CBRE, Dallas.

Commercial Real Estate Lending Showing Resilience

The improving economy created a favorable capital markets environment for commercial real estate lending in early 2021 despite continuing challenges in office and retail loan underwriting, said CBRE, Dallas.

‘No Signs of Slowing’ for Industrial Sector

The U.S. industrial market “shows no signs of slowing down,” with record-high asking rents and development activity and low vacancy levels, reported CBRE, Dallas.

Dealmaker: CBRE Closes $39M in Office Transactions

CBRE, Dallas, closed $38.6 million in office sector transactions in southern California.