The Bascom Group LLC, Irvine, Calif., acquired Sierra Charles Apartments in metro Tucson, Ariz. for $11.6 million, or $59,164 per unit.

Tag: CBRE

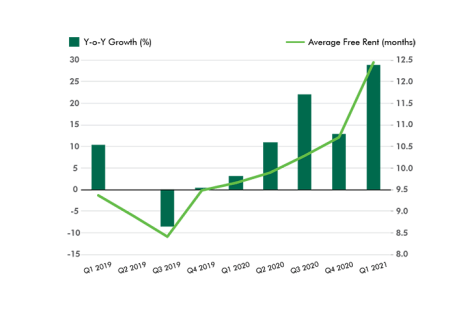

CBRE: Rent Enticements Larger Factor in New Office Leases

CBRE, Dallas, said the average amount of free rent office landlords conceded to secure long-term leases climbed significantly in the first quarter.

Hotel Sector Showing Signs of Life

The hotel sector is coming back–slowly–from its pandemic-related downturn, analysts said.

Dealmaker: Shopoff Realty Investments Secures $105M Construction Loan For Logistics Center

Shopoff Realty Investments, Irvine, Calif., secured a $105 million construction loan for its I-10 Logistics Center project, located near the I-10 freeway and Cherry Valley Boulevard interchange.

Dealmaker: CBRE Arranges $54M for Industrial, Multifamily

CBRE arranged $54 million for an industrial property and a multifamily property in metropolitan San Diego.

CRE Investors Show Increased Appetite for Risk

CBRE, Dallas, said commercial real estate investors are showing a clear shift in risk tolerance–and a new preference for secondary markets.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.