CBRE: Rent Enticements Larger Factor in New Office Leases

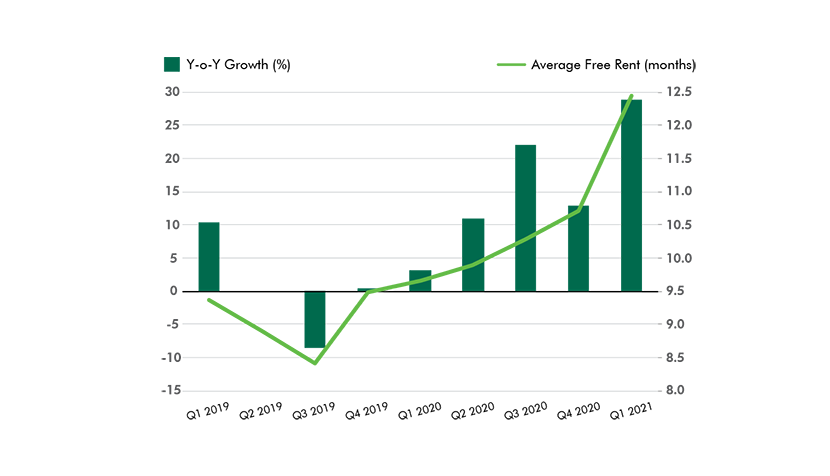

(Average free rent concessions chart courtesy CBRE.)

CBRE, Dallas, said the average amount of free rent office landlords conceded to secure long-term leases climbed significantly in the first quarter.

Office property owner rent concessions to occupiers climbed to 12.5 months for newly signed leases at least 10 years long, up 29 percent from a year earlier, CBRE said.

“Companies seeking long-term leases will find that asking rents haven’t come down much, but overall concessions have increased,” said CBRE Global President of Advisory & Transaction Services Whitley Collins. “Those willing to get out in front of the full economic recovery can expect most landlords to be very accommodating.”

Collins noted early signs that concessions may cool a bit, “but they are small factors at best,” he said. “For example, average rent declines got smaller over the past two quarters.”

CommercialEdge, Santa Barbara, Calif., said the office industry “continues to struggle” after the COVID-19 pandemic forced many firms to shift their employees to remote work. “The effects of this shift are still reverberating across the industry and causing increased vacancies, losses in office employment, lagging sales and a forecasted decline in construction,” CommercialEdge Analyst Andreea Popescu said in the firm’s most recent National Office Report.

Popescu said the national average full-service equivalent listing rate was down 0.6 percent year-over-year in February. The national vacancy rate currently stands at 15 percent, a 160-basis-point increase from a year ago and a 40-basis point-uptick month-over-month.

“The effect of the pandemic on rising vacancies was most evident in central business district submarkets, where typically high density is incompatible with social distancing requirements,” Popescu said. “As such, office space in urban cores saw the greatest increase in vacancies.”

Meanwhile, CBRE reported tenant-improvement allowances–money landlords give tenants to finish office interiors–have held steady at an average of $70 to $75 per square foot.

For the past year, office occupiers have held the advantage over their landlords in lease negotiations amid uncertainty about the timing of an economic recovery and the effectiveness of efforts to thwart the COVID-19 virus. “As vaccinations have gained momentum and government stimulus bolsters consumer spending, signs of a strong economic recovery are increasingly evident,” CBRE said. “But how quickly that rebound will benefit the office leasing market remains to be seen.”