Here is a summary of recent housing reports that have come across the MBA NewsLink desk:

Tag: Black Knight

Industry Briefs Feb. 27, 2023: CoreLogic Acquires Roostify

CoreLogic, Irvine, Calif., a global property information, analytics and data-enabled services provider, acquired Roostify, San Francisco, a digital mortgage technology provider.

Industry Briefs Feb. 17, 2023: Homes Bought with Cash Down from November Peak

Redfin, Seattle, said roughly one-third (31.2%) of U.S. home purchases were paid for with all cash in December, up from 28.8% a year earlier but down from the eight-year high of 31.9% hit in November.

Mortgage Performance Remains ‘Exceptionally Healthy’

Reports this week from CoreLogic, Irvine, Calif., and Black Knight, Jacksonville, Fla., as well as Monday’s Loan Monitoring Report from the Mortgage Bankers Association, show mortgage performance in the post-pandemic era remains strong and healthy.

Housing Market Roundup Jan. 10, 2023

Here’s a summary of recent housing/economics articles that came across the MBA NewsLink desk:

Housing Market Roundup Nov. 23, 2022

We’ve had a flurry of reports ahead of the Thanksgiving holidays; here’s a quick summary of what’s happening:

Industry Briefs Nov. 18, 2022: Revvin Releases HELOC-Ready Workflows

Revvin, Chicago, released a set of HELOC-specific workflows that make it easier for lenders to attract home equity line of credit applicants and gather the required information for delivery to the lender’s LOS.

Industry Briefs Oct. 25, 2022: NewDay USA to West Palm Beach?

NewDay USA, Fulton, Md., is expanding and taking occupancy with 250 employees in the top two floors of 360 Rosemary, a 20-story, 297,000-square-foot office building in West Palm Beach, Fla.. In addition, the company is in negotiations with Related Co. to relocate its Maryland-based headquarters to West Palm Beach.

Sponsored Content from Black Knight: Homebuying from Start to Finish with Black Knight

Learn how Black Knight’s integrated solutions innovate every step in the real estate and mortgage processes.

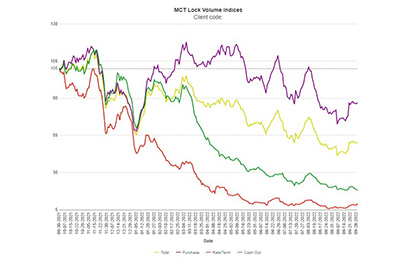

Cash-Outs, Purchase Locks Decline Amid Record-Low Affordability

Black Knight, Jacksonville, Fla., said cash-out refinances fell significantly in September, by 26.2 percent from August alone and by 78 percent from a year ago. A similar report from MCT, San Diego, also found a sharp drop in loan lock volume in September.