Monthly mortgage payments between $2,000 and $3,000 have rapidly become the norm in today’s housing market in the face of spiking interest rates and historically high home prices, reported Black Knight, Jacksonville, Fla.

Tag: Black Knight Mortgage Monitor

Black Knight: Nearly a Quarter of Homebuyers Face $3,000 Payments or More

Monthly mortgage payments between $2,000 and $3,000 have rapidly become the norm in today’s housing market in the face of spiking interest rates and historically high home prices, reported Black Knight, Jacksonville, Fla.

Black Knight: Nearly a Quarter of Homebuyers Face $3,000 Payments or More

Monthly mortgage payments between $2,000 and $3,000 have rapidly become the norm in today’s housing market in the face of spiking interest rates and historically high home prices, reported Black Knight, Jacksonville, Fla.

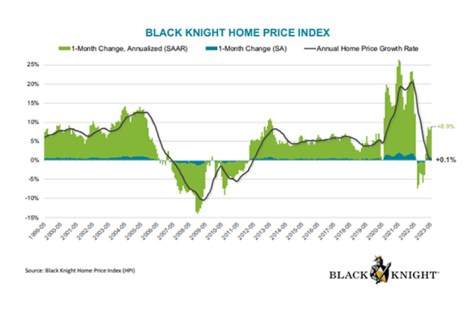

Black Knight: Home Prices Hit Record in May

Black Knight, Jacksonville, Fla., found in its Mortgage Monitor Report that its seasonally adjusted Home Price Index hit a new high in May, with the price decreases over the past year having fully reversed.

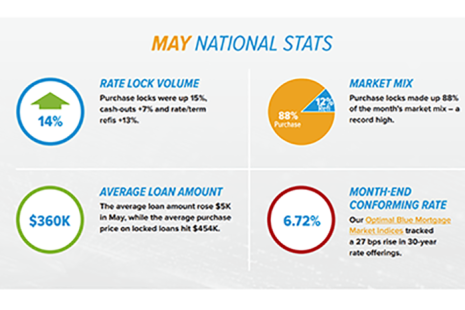

Mortgage Locks See Modest Rise in May, But Remain Suppressed, Black Knight Reports

Mortgage lending improved in May compared to April, but remains constrained to say the least, reported Black Knight, Jacksonville, Fla.

Housing Market Report: Sellers Retreat; Million-Dollar Homes, Affordable Homes Decrease

In today’s housing market reports, Black Knight, Jacksonville, Fla., said sellers continue to back away amid rising interest rates; and Redfin, Seattle, said inventory of homes at both ends of the spectrum have become less available.

Black Knight: More than Half of Borrowers Using Rate Buydowns

Black Knight, Jacksonville, Fla., said 57 percent of recent borrowers used rate buydowns to purchase a home, with nearly 25 percent paying two or more points upfront.

Housing Market Roundup: Dec. 23, 2022

Here’s a summary of housing market/economic stories that came across the MBA NewsLink desk this week:

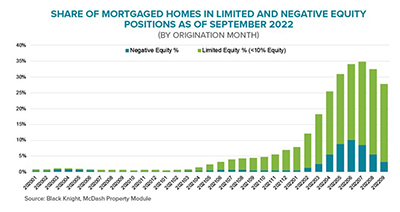

Black Knight: 8% of 2022 Mortgaged Home Purchases Underwater; FHA Loans See Early-Payment Defaults Rise

Black Knight, Jacksonville, Fla., said of all homes purchased with a mortgage in 2022, 8% are now at least marginally underwater and nearly 40% have less than 10% equity stakes in their home, a situation most concentrated among FHA/VA loans.