Housing Market Roundup: Dec. 23, 2022

Here’s a summary of housing market/economic stories that came across the MBA NewsLink desk this week:

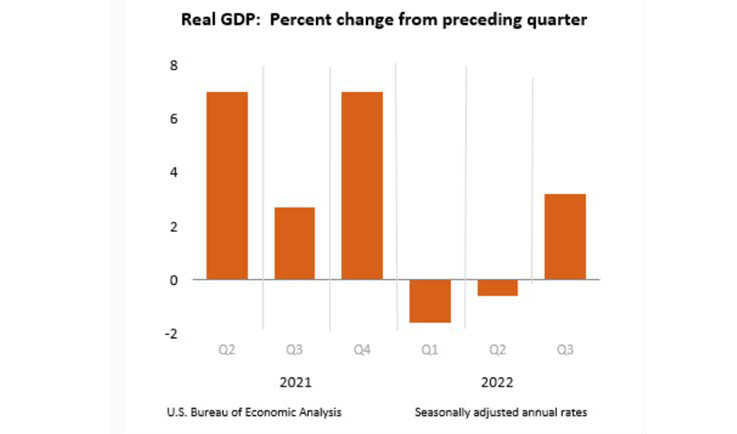

3rd Quarter GDP Finishes Stronger

Real gross domestic product increased at an annual rate of 3.2 percent in the third quarter, according to the third (final) estimate released Thursday by the Bureau of Economic Analysis. In the second quarter, real GDP decreased by 0.6 percent.

The final estimate of GDP is based on more complete source data than were available for the second estimate issued last month. In the second estimate, the increase in real GDP was 2.9 percent. The updated estimates primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment.

BEA said the increase in real GDP for the third quarter reflected increases in exports, consumer spending, nonresidential fixed investment, state and local government spending, and federal government spending, partly offset by decreases in residential fixed investment and private inventory investment. Imports decreased.

Real GDP turned up in the third quarter, increasing 3.2 percent after decreasing 0.6 percent in the second quarter. The upturn primarily reflected accelerations in nonresidential fixed investment and consumer spending, a smaller decrease in private inventory investment, and upturns in state and local as well as federal government spending that were partly offset by a larger decrease in residential fixed investment. Imports turned down.

Current‑dollar GDP increased 7.7 percent at an annual rate, or $475.5 billion, in the third quarter to a level of $25.72 trillion (table 1 and table 3), an upward revision of $25.0 billion from the previous estimate. More information on the source data that underlie the estimates is available in the “Key Source Data and Assumptions” file on BEA’s website.

The price index for gross domestic purchases increased 4.8 percent in the third quarter (table 4), an upward revision of 0.1 percentage point from the previous estimate. The PCE price index increased 4.3 percent, unchanged from the prior estimate. Excluding food and energy prices, the PCE price index increased 4.7 percent, revised up 0.1 percentage point.

Black Knight’s First Look: Prepayments Hit Third Consecutive Record Low

Black Knight, Jacksonville, Fla., said its First Look Mortgage Monitor said prepayment activity in November dropped by 15.6% to a single month mortality rate of 0.40% – once again marking the lowest rate on record since before 2000 when Black Knight started reporting the metric.

The report said the national delinquency rate rose by another 3.5% in November to 3.01%, up 10 basis points since October, driven by a 31,000 (+3.9%) increase in 30-day delinquencies and a 25,000 (+11%) rise in 60-day delinquencies.

The delinquency rate in Florida rose another 18 basis points in the month to 3.60% as the impact of Hurricane Ian on homeowners’ ability to make mortgage payments continues.

The report said improvement among seriously past-due loans continues to stagnate, with the population of 90-day delinquencies ticking down -0.2% from the month prior. Foreclosure starts rose again (+19%) on the heels of October’s increase, but the month’s 23,400 starts are still below the recent high seen in June 2022 and remain 30% below pre-pandemic levels.

Black Knight said foreclosure was started on 4.3% of serious delinquencies in November, up 7 basis points from October but still 44% less than the rate seen in the years leading up to the pandemic. Active foreclosure inventory rose by 5.3%, though 2022 volumes remain subdued after the record lows of 2021 due to widespread moratoriums and forbearance protections.

Initial Claims Ticks Higher

Initial claims for unemployment insurance increased slightly last week, the Labor Department reported Thursday, but remained well below pandemic levels.

For the week ending December 17, the advance figure for seasonally adjusted initial claims rose to 216,000, an increase of 2,000 from the previous week’s revised level. The 4-week moving average fell to 221,750, a decrease of 6,250 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate was unchanged at 1.2 percent for the week ending December 10. The advance number for seasonally adjusted insured unemployment during the week ending December 10 fell to 1,672,000, a decrease of 6,000 from the previous week’s revised level. The four-week moving average rose to 1,657,250, an increase of 30,250 from the previous week’s revised average.

The advance number of actual initial claims under state programs, unadjusted, totaled 247,867 in the week ending December 17, a decrease of 4,064 (-1.6 percent) from the previous week. The seasonal factors had expected a decrease of 6,410 (-2.5 percent) from the previous week. There were 255,021 initial claims in the comparable week in 2021.

The advance unadjusted insured unemployment rate was unchanged at 1.1 percent during the week ending December 10. The advance unadjusted level of insured unemployment in state programs totaled 1,597,223, an increase of 85,084 (5.6 percent) from the preceding week. The seasonal factors had expected an increase of 90,628 (6.0 percent) from the previous week. A year earlier the rate was 1.4 percent; volume was 1,827,628.

The total number of continued weeks claimed for benefits in all programs for the week ending December 3 fell to 1,537,044, a decrease of 49,110 from the previous week. There were 2,138,003 weekly claims filed for benefits in all programs in the comparable week in 2021.