Black Knight: Home Prices Hit Record in May

(Courtesy Black Knight)

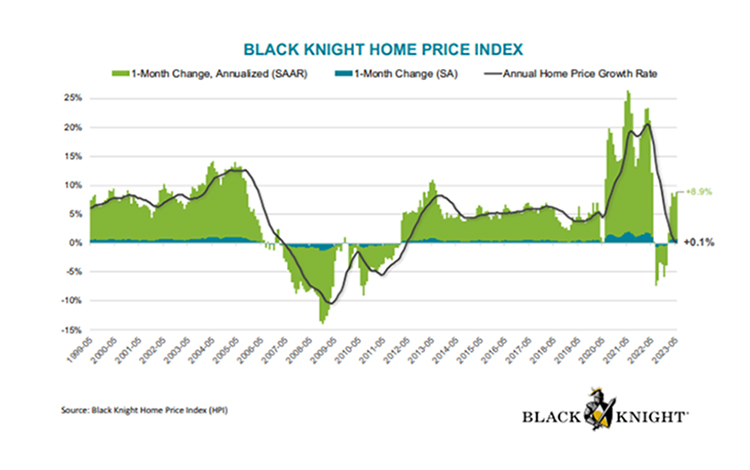

Black Knight, Jacksonville, Fla., found in its Mortgage Monitor Report that its seasonally adjusted Home Price Index hit a new high in May, with the price decreases over the past year having fully reversed.

In May, annual home price growth sat at 0.1%, but the company noted it could begin trending higher as soon as next month if predictions bear out.

In a fifth straight month of gains, May’s 0.7% seasonally adjusted monthly increase equates to an annualized growth rate of 8.9%, which Black Knight predicted will cause an inflection in home price appreciation.

“There is no doubt that the housing market has reignited from a home price perspective,” said Black Knight Vice President of Enterprise Research Andy Walden.

Of the 50 largest markets in the U.S., 27 returned to home price peaks or above, although Black Knight noted those are largely in the Midwest and Northeast.

Inventory has decreased in 95% of major markets this year. For-sale inventory did improve somewhat but is still 51% off pre-pandemic levels and continues to exert pressure on prices.

It takes 35.7% of median household income to make the average principal and interest payment. While income growth has tempered the issues somewhat, housing affordability remains a major concern.

“As it stands, housing affordability remains dangerously close to the 37-year lows reached late last year, despite the Federal Reserve’s attempts to cool the market,” Walden said. “The challenge for the Fed now is to chart a path forward toward a ‘soft landing’ without reheating the housing market and reigniting inflation. But the same lever used to reduce demand–that is, raising rates–has not only made housing unaffordable almost universally across major markets, it has also resulted in significant supply shortages by discouraging potential sellers unwilling to list in such an environment, further strengthening prices.”