SAN DIEGO–MBA President and CEO Bob Broeksmit, CMB, highlighted challenges to the commercial real estate finance industry–from Basel III to affordability–here at the MBA Commercial/Multifamily Finance Convention and Expo.

Tag: Basel III endgame rule

Broeksmit Discusses Recent Wins, Current Challenges: #MBAIMB24

NEW ORLEANS–In the face of a difficult business climate, the Mortgage Bankers Association is fighting for Independent Mortgage Bankers every day to ensure they can deliver for borrowers, MBA President and CEO Robert Broeksmit, CMB, said here at MBA’s Independent Mortgage Bankers conference.

MBA Continues to Cite ‘Substantial Concerns’ in Basel III NPR Comments

Following a joint comment letter with other trade groups submitted last week, the Mortgage Bankers Association also outlined more in depth concerns about the Notice of Proposed Rulemaking regarding the implementation of the final components of the Basel III standards in a separate letter Tuesday.

Broeksmit Testifies That MBA Opposes Certain Provisions of the Basel III Proposal

MBA President and CEO Robert Broeksmit, CMB, testified before Congress yesterday. He told the House Financial Services Committee that MBA strongly opposes key elements of the Basel III proposal, which, absent significant revisions, could increase borrowing costs and reduce credit availability.

Broeksmit Testifies That MBA Opposes Certain Provisions of the Basel III Proposal

MBA President and CEO Robert Broeksmit, CMB, testified before Congress yesterday. He told the House Financial Services Committee that MBA strongly opposes key elements of the Basel III proposal, which, absent significant revisions, could increase borrowing costs and reduce credit availability.

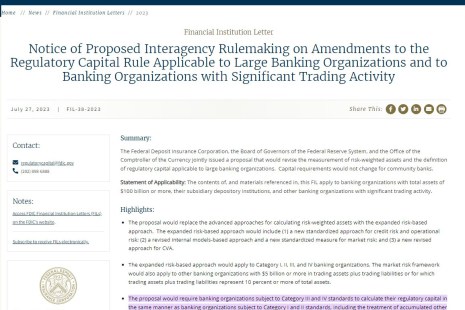

Banking Agencies Issue MBA-Opposed Proposed Changes to Bank Capital Requirements

The Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency on Thursday issued interagency proposed changes to capital requirements for banks with assets of $100 billion or more. The so-called “end game” proposed rules complete U.S. regulators’ implementation of the Basel III standards and make changes in response to the recent large bank failures. MBA strongly opposes certain provisions of the proposal.

Banking Agencies Issue MBA-Opposed Proposed Changes to Bank Capital Requirements

The Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency on Thursday issued interagency proposed changes to capital requirements for banks with assets of $100 billion or more. The so-called “end game” proposed rules complete U.S. regulators’ implementation of the Basel III standards and make changes in response to the recent large bank failures. MBA strongly opposes certain provisions of the proposal.

Quote: July 28, 2023

“Without significant revisions, this proposal will increase borrowing costs and reduce credit availability for the very consumers and borrowers this administration ostensibly seeks to assist. The large increases in capital standards will likely stunt macroeconomic growth and reduce banks’ participation as single-family and commercial/multifamily lenders, servicers, and providers of warehouse lines and mortgage servicing rights financing.”

–Bob Broeksmit, CMB, President and CEO of the Mortgage Bankers Association, commenting on the interagency proposed rule released Thursday for the final implementation of the Basel III international regulatory framework.

MBA Opposes Proposed Rulemaking Implementing Basel III Endgame and Making Changes to Capital Requirements for Banks

The Mortgage Bankers Association strongly urged federal policymakers to vote against a proposed Notice of Proposed Rulemaking implementing the Basel III “endgame” rule, which is set for consideration on July 27. The rule is expected to impose a 15 to 20 percent increase in capital requirements for larger institutions.