Banking Agencies Issue MBA-Opposed Proposed Changes to Bank Capital Requirements

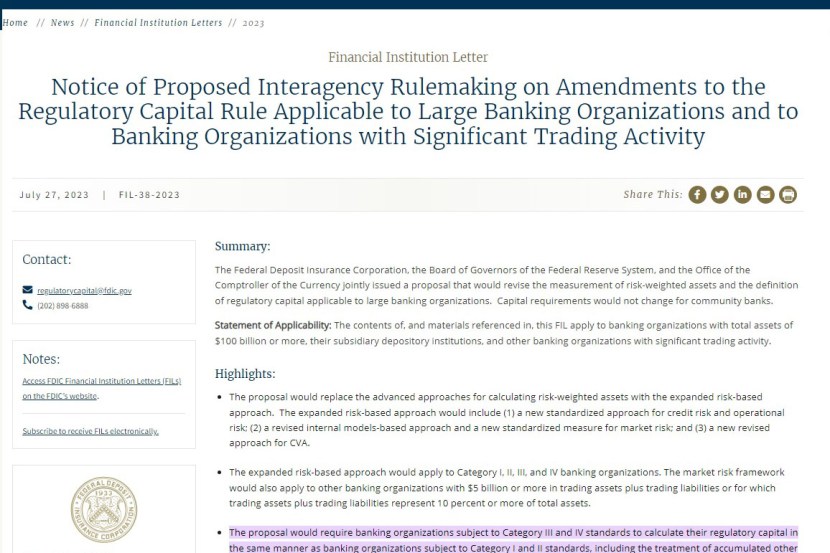

The Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency on Thursday issued interagency proposed changes to capital requirements for banks with assets of $100 billion or more. MBA strongly opposes certain provisions of the proposal.

The so-called “end game” proposed rules complete U.S. regulators’ implementation of the Basel III standards and make changes in response to the recent large bank failures.

The proposed changes effectively increase capital requirements at larger banks by about 15 to 20 percent – large enough to impact which lines of business banks choose to support or withdraw from. MBA, which opposes certain provisions of the proposal, on Wednesday sent an open letter to the leadership at the banking agencies that urged them to vote against its issuance, highlighting that the substantial capital hike will have both macroeconomic and sector impacts and would fundamentally shift what business lines mid-sized and regional banks will focus on.

“This unnecessary proposal will increase borrowing costs and reduce credit availability for the very consumers and borrowers this administration ostensibly seeks to assist,” said MBA President and CEO Bob Broeksmit, CMB. “Experience with such significant capital changes tells us that equity markets will react immediately, and banks will respond to that pressure in real time, long before the final rule is issued.”

-Why it matters: The agencies’ proposal makes significant changes to how banks calculate their risk-weighted assets and imposes several additional requirements on banks with total assets of $100B or more, including a modification of current rules on the deduction of threshold items (including MSRs) from common equity tier 1 capital, and a requirement to include net unrealized losses on available-for-sale securities in the calculation of regulatory capital. The proposal also changes the risk weighting on certain mortgage loans held by the largest banks – a provision that goes beyond the Basel III Accord – that in turn could make homeownership less attainable to first-time homebuyers and low- and -moderate-income borrowers with smaller down payments. The proposed changes were made with scant economic analysis regarding how they will impact lending, and how it will be distributed by sector.

-What’s next: Comments on the proposal are due by November 30, 2023, with July 1, 2025, as the start of a three-year transition period provided for the final rule. MBA is currently reviewing the over 1,000-page proposal and will provide a summary of the key provisions impacting single-family and commercial/multifamily sectors in the coming days. MBA will work with members and other industry stakeholders to formulate our response, focusing on the numerous negative impacts these proposed rules would have on the housing finance ecosystem.