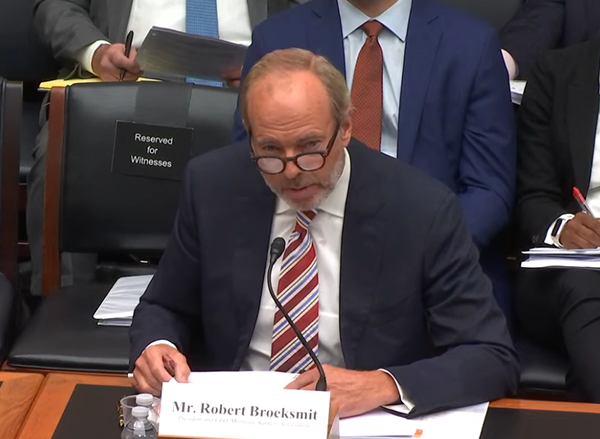

Broeksmit Testifies That MBA Opposes Certain Provisions of the Basel III Proposal

MBA President and CEO Robert Broeksmit, CMB, testified before Congress yesterday. He told the House Financial Services Committee that MBA strongly opposes key elements of the Basel III proposal, which, absent significant revisions, could increase borrowing costs and reduce credit availability.

Details of the hearing are available here. Click here for a copy of Broeksmit’s written statement.

On July 27, the Federal Reserve, Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency (Banking Agencies) issued a Notice of Proposed Rulemaking to update capital requirements for banks with assets of $100 billion or more. The so-called “end game” proposed rules complete U.S. regulators’ implementation of the Basel III standards and ostensibly make changes in response to the recent large bank failures. The proposed changes effectively increase capital requirements at larger banks by an estimated 15 to 20 percent – large enough to impact credit availability economy-wide, as well as which lines of business banks choose to support – with potential implications for the entire mortgage market.

Broeksmit noted the new rules will impact more than three dozen large U.S. banks, including more than two dozen regional banks that support the mortgage market and are not currently subject to the heightened capital standards on U.S. “GSIBs” (Globally Systemically Important Banks), i.e., the eight largest banks. “These large banks play a critical role in the mortgage market as lenders, mortgage holders, servicers, aggregators, and providers of warehouse and mortgage servicing rights financing – functions that could be impaired if this rule is not changed,” he told the committee.

Broeksmit said MBA believes the NPR poses unwarranted risks to the U.S. economy, to housing and real estate markets specifically, and contradicts many of the Biden Administration’s policy goals, including those pertaining to affordable housing (both ownership and rental), fostering bank competition over consolidation, and the closing of significant racial homeownership and wealth gaps. It is still unclear how the proposed rulemaking interacts with other regulatory proposals, and how these rules collectively could stunt economic growth and credit access needed to support the creation of more affordable ownership and rental housing from the largest providers of capital in the country, he said.

“It is also unclear what specific problems the NPR is trying to solve, considering that the Federal Reserve and U.S. Treasury have consistently stated that the banking system is strong. For example, capital ratios of large banks operating in the U.S. have more than doubled since the Great Financial Crisis, and more than a decade of real-life experience has demonstrated that banks have adequate capital to withstand significant economic shocks. In fact, recent stress test results confirm that the banking system is safe and well-capitalized,” Broeksmit added.

The proposed rule also lacks the robust economic impact analysis that usually accompanies such a significant change in bank capital standards – just fifteen pages of impact assessment out of nearly 1,100 pages, Broeksmit noted. “We believe the analytical shortcomings were a significant factor in the remarkably close votes at the FDIC and Federal Reserve Board prior to the NPR’s issuance,” he said. “Most of the previous proposed capital rules implementing the Basel framework were unanimously approved by the Banking Agencies and involved at least one quantitative impact study (QIS) – and when warranted, multiple rounds of QIS. Any major change in public policy warrants a reasonable consideration of its effects and impacts – especially when the policy change directly impacts everything from the cost of funds for our largest financial institutions to the costs for ordinary Americans looking to purchase a home. The lack of independent and original analysis conducted prior to the release of such a consequential regulatory sea change is extremely troubling.”

The Basel III proposal would have implications for residential as well as commercial mortgages and macro implications for housing, Broeksmit told Congress.

“MBA strongly opposes certain provisions of the proposal that undermine the mortgage market and takes exception to the extremely scant economic analysis regarding how the changes will affect the economy, single-family housing market, and commercial real estate finance markets,” Broeksmit said. “Given ongoing affordable housing challenges, regulators should be taking steps that encourage banks to better support real estate finance markets. Instead, these proposed changes do precisely the opposite during a time of near record-low single-family delinquencies and pristine underwriting. This proposal also undermines several current policy objectives of the Biden Administration, including efforts to close the racial homeownership and wealth gaps, the provision of affordable housing (both ownership and rental), the promotion of competition over consolidation, and the upcoming unveiling of a final CRA rule.”

Broeksmit’s testimony noted MBA stands ready to collaborate with members of the subcommittee and the full House Financial Services Committee on this and other policy proposals, “to ensure a robust housing market that is accessible, affordable, and sustainable – and works to benefit all borrowers, renters, and other critical stakeholders.”