ATTOM, Irvine, Calif., showed a jump in foreclosures in its Q3 U.S. Foreclosure Market Report. At 124,539 properties with foreclosure filings, they’re up 28% from Q2 and 34% from last year.

Tag: ATTOM

ATTOM: Foreclosure Activity Up in Third Quarter

ATTOM, Irvine, Calif., showed a jump in foreclosures in its Q3 U.S. Foreclosure Market Report. At 124,539 properties with foreclosure filings, they’re up 28% from Q2 and 34% from last year.

Home Affordability Continues to Challenge Americans, ATTOM Says

The ATTOM, Irvine, Calif., third-quarter 2023 U.S. Home Affordability Report revealed median-priced single-family homes and condos are less affordable compared with historical averages in 99% of counties where the firm had enough data to analyze.

Home Affordability Continues to Challenge Americans, ATTOM Says

The ATTOM, Irvine, Calif., third-quarter 2023 U.S. Home Affordability Report revealed median-priced single-family homes and condos are less affordable compared with historical averages in 99% of counties where the firm had enough data to analyze.

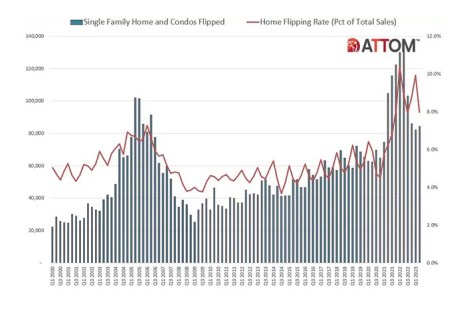

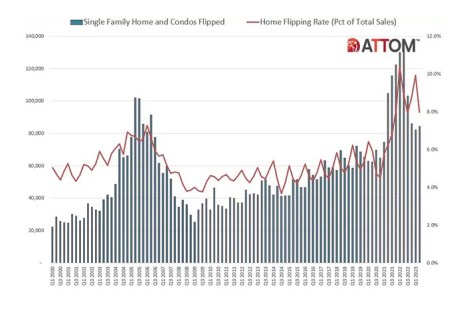

ATTOM: Home Flipping Drops in Q2

ATTOM, Irvine, Calif., found home flipping activity fell in the second quarter.

ATTOM: Home Flipping Drops in Q2

ATTOM, Irvine, Calif., found home flipping activity fell in the second quarter.

ATTOM: Home Flipping Drops in Q2

ATTOM, Irvine, Calif., found home flipping activity fell in the second quarter.

ATTOM: Home Flipping Drops in Q2

ATTOM, Irvine, Calif., found home flipping activity fell in the second quarter.

ATTOM: August Foreclosure Filings Up From July, Down From 2022

ATTOM, Irvine, Calif., reported in its August 2023 U.S. Foreclosure Market Report that there were 33,952 U.S. properties with foreclosure filings. That’s up 7% from July but down 2% year-over-year.

ATTOM: August Foreclosure Filings Up From July, Down From 2022

ATTOM, Irvine, Calif., reported in its August 2023 U.S. Foreclosure Market Report that there were 33,952 U.S. properties with foreclosure filings. That’s up 7% from July but down 2% year-over-year.