“Nearly 96% of all home mortgages are performing, which underscores how strong servicing portfolio performance is right now with the same resilience seen in the U.S. labor market.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis.

“Nearly 96% of all home mortgages are performing, which underscores how strong servicing portfolio performance is right now with the same resilience seen in the U.S. labor market.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis.

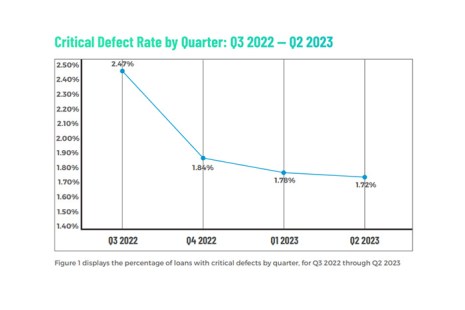

“Q2 2023 proved to be better than expected, as the critical defect rate continued to decline in the face of a surge in origination volume over the previous quarter.”

–Nick Volpe, Executive Vice President of ACES Quality Management

ACES Quality Management, Denver, Colo., reported the critical defect rate for the second quarter of 2023 fell to 1.72%, a 3.37% decrease and the third consecutive quarter of declines.

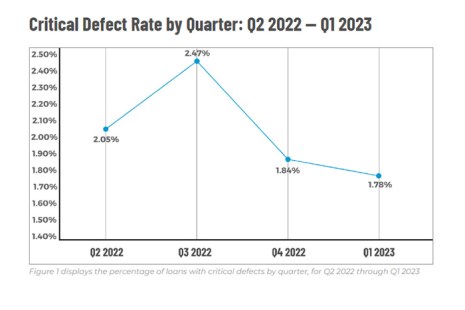

ACES Quality Management, Denver, reported the overall critical defect rate for the first quarter of 2023 was 1.78%. That’s down 3.26% from the previous quarter, and the second straight quarter of declines.

ACES Quality Management, Denver, reported the overall critical defect rate for the first quarter of 2023 was 1.78%. That’s down 3.26% from the previous quarter, and the second straight quarter of declines.

Amidst changing QC requirements and increasing repurchase risk, lenders must invest in automation to drive efficiency and protect profits.

Amidst changing QC requirements and increasing repurchase risk, lenders must invest in automation to drive efficiency and protect profits.

Amidst changing QC requirements and increasing repurchase risk, lenders must invest in automation to drive efficiency and protect profits.

Amidst changing QC requirements and increasing repurchase risk, lenders must invest in automation to drive efficiency and protect profits.

Amidst changing QC requirements and increasing repurchase risk, lenders must invest in automation to drive efficiency and protect profits.