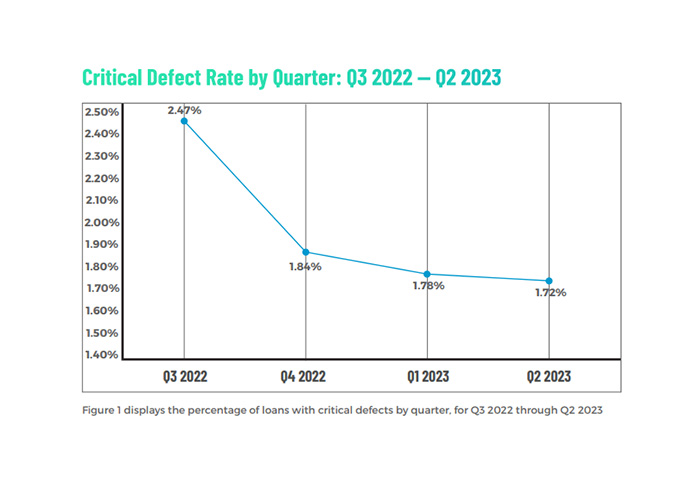

ACES: Critical Defect Rate Falls for Third Straight Quarter

(Image courtesy of ACES)

ACES Quality Management, Denver, Colo., reported the critical defect rate for the second quarter of 2023 fell to 1.72%, a 3.37% decrease and the third consecutive quarter of declines.

“Q2 2023 proved to be better than expected, as the critical defect rate continued to decline in the face of a surge in origination volume over the previous quarter. However, deteriorating quality in the core underwriting categories remains of concern and should be an area in which lenders increase their focus in the coming months,” said Nick Volpe, Executive Vice President of ACES Quality Management

Defects in the Credit and Liabilities categories increased. The rise in Credit was notable–an increase of 114.34% to end the quarter at 11.81% of defects.

Income/Employment and Assets continued to improve–although they remained the top two defect categories for the quarter.

Income/Employment’s defect share remained fairly stable at 31.25%, down by less than 1%. Assets were at 15.97%, despite improving a bit over the quarter.

Federal Housing Administration loan critical defects (41.18% of the total) rose in the quarter. Critical defects decreased across United States Department of Agriculture (1.68%), Veterans’ Affairs (6.72%) and conventional loans (50.42%).