ULI & RCLCO: Households Face Significantly Higher Cost Burdens Than a Decade Ago

(Illustration courtesy of ULI & RCLCO)

Housing cost burden is increasing across the country. In nearly every major market, households earning under $50,000 are significantly more cost-burdened than they were 10 years ago, according to the Urban Land Institute and RCLCO.

“This lends quantitative support to what Americans are already feeling: Every region of the country is growing more unaffordable,” ULI and RCLCO said in announcing the ULI Terwilliger Center for Housing’s 2025 Home Attainability Index, which measures affordability, connectivity, racial disparity and growth across the United States. “By spending over one-third of their income on the cost of renting or owning, it is becoming increasingly difficult for low- and moderate-income households to pay for other life necessities or even make ends meet. The nationwide affordability crisis is continuing to worsen, and concerted efforts to increase the country’s housing stock are needed at all levels of government to reverse this trend.”

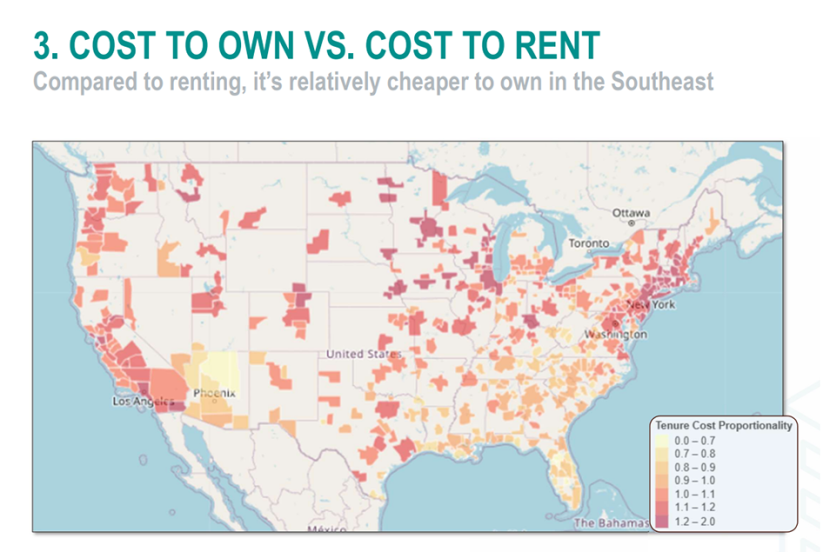

The report noted housing attainability varies widely by region. Home prices and rents are rising dramatically in certain U.S. markets and stabilizing in others. “For instance, households in the Rust Belt earning 120% AMI have ample opportunity to purchase homes, while household in in the West even with above average incomes have few options,” it said. “Additionally, rents in large metro areas and western markets can easily be double or triple the cost compared to smaller, midwestern cities. Housing costs have always driven migration patterns in the U.S. and the most recent data suggests that housing cost in high growth markets like the Southeast and Intermountain West are beginning to redirect growth.”

Historically, most affordability changes have been confined to competitive coastal markets, but the trend is now spreading inland, the report said. It noted the cost to purchase a home in several northwestern markets including Jackson Hole, Wyo.; Boise, Idaho and Bozeman, Mont. rose by 50 percent from 2020-2023, the highest increase in housing cost throughout the country. “This enormous price surge–occurring just over a few years–is forcing the local low- and moderate-income populations out of their communities overnight. Once uncharacteristic for the region, the rising prices highlight the consequences of sidelining affordable housing production and underscore that no part of the country is immune to the ongoing nationwide affordability crisis.”

The report found that rent increases are more limited where housing production has increased. Austin, Texas, Nashville, Tenn. and Raleigh, N.C. are among the top 15 markets for new housing built relative to their size, and all three metros have seen the least rent growth relative to their peer markets where less development has occurred.

Finally, housing development is concentrated in the suburbs, RCLCO and ULI found. Following the 2010s–a period of strong housing activity in America’s urban cores and inner suburbs–activity has moved back to the suburban edge as builders chase more affordable land and construction types that lower the cost of production.