Optimal Blue: Refinances Jump in March

(Image courtesy of Optimal Blue)

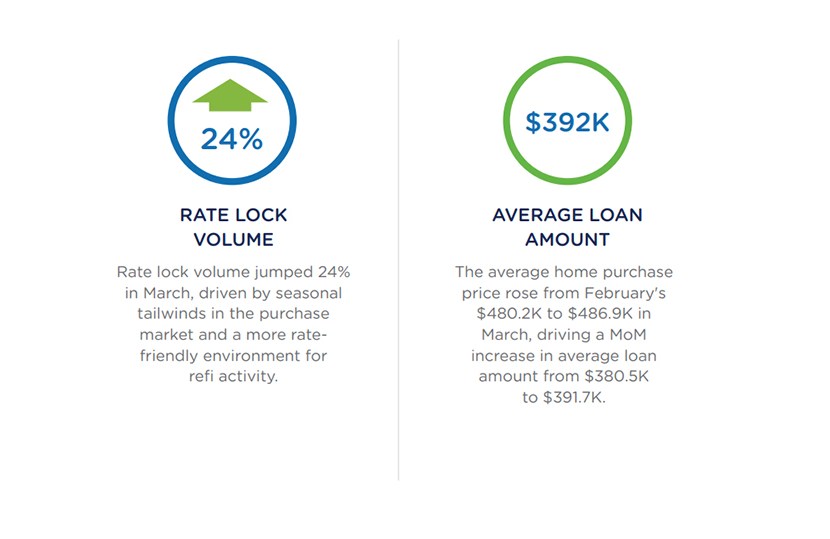

Optimal Blue, Plano, Texas, released its March 2025 Market Advantage mortgage data report, finding a 24% increase in rate lock volume, attributed to early spring buyers entering the market and homeowners refinancing with recent lower rates.

Purchase volumes were up 21% month-over-month, but hover 2% below last year.

But, refinances surged, with rate-and-term refinances up 52% month-over-month and cash-out refinances up 20%.

“March brought a notable shift in borrower behavior,” said Brennan O’Connell, Director of Data Solutions at Optimal Blue. “Refinances made up a quarter of all lock activity for the first time in six months, and we saw a clear rise in non-conforming loan share as buyers looked for more flexible options and higher loan amounts. These are key indicators that consumers are actively adapting to the current rate environment.”

The share of non-conforming loans rose, with non-Agency loan share hitting its highest level since April 2022. Non-conforming loans were 16.8% of total rate lock volume, with conforming loan share at 51% and FHA share at 19.6%. VA volume grew to nearly 12%.

Adjustable-rate mortgages also grew in March, making up just below 9% of total rate lock volume.

The average credit score for cash-out refinances rose to 735, up 3 points month-over-month, and the average credit score for rate-and-term refinances rose to 699, also up 3 points. The average credit score for purchases was 737, flat from last month.

The average home purchase price in March was $486,900, up from $480,200. The average loan amount grew to $391,700 in the month from $380,500.