Colliers: Big-Box Industrial Properties Lead the Way

(Illustrations courtesy of Colliers)

Big-box industrial buildings have led the way for the overall industrial market over the past several years according to Colliers, Seattle.

Modern industrial buildings exceeding 200,000 square feet with 28-plus foot ceiling heights — have attracted the majority of the record demand since the pandemic, Colliers National Directors of Industrial Research Craig Hurvitz and Stephanie Rodriguez said in their Big Box Outlook report.

“While core markets — the Inland Empire, Dallas-Fort Worth, Atlanta, Chicago, Northern-Central New Jersey, and Eastern Pennsylvania Tri-State — remain favorites by occupiers, many secondary markets are also emerging, typically close to the fastest-growing population centers and the most-used logistics hubs in their regions,” the report said.

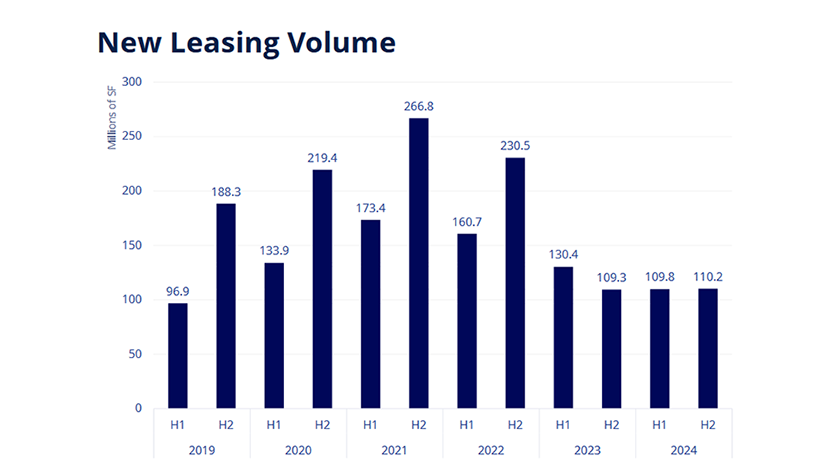

Since 2020, the 20 largest North American markets for big-box industrial space have added an “unprecedented” 1.3 billion square feet of new supply, expanding the big-box market by nearly 50%. “[But] while pandemic-driven demand once pushed vacancy rates near zero in some markets, a recent wave of new supply combined with demand falling below pre-pandemic levels has led to rising vacancies,” the report said.

Net absorption reached 101 million square feet in 2024 — a 34% drop from the previous year and 72% below the peak demand seen in 2021. “More than half of the net absorption during 2024 was in buildings 750,000 square feet or larger, while demand was weakest in buildings between 500,000 and 749,999 square feet,” the report said.

At the same time, developers delivered 202 million square feet of big-box space, twice the amount of demand. The market has yet to regain balance, the report noted. “As a result, vacancy rose by 80 basis points over the year, to 11%. Vacancy was highest in buildings between 500,000 and 749,999 square feet at 11.7%, while buildings 750,000 square feet and larger had the lowest rate at 10.2% — a decrease of 159 basis points in this segment over the past year.”

Big-box vacancy will likely peak and begin to fall again this year as new supply falls in line with levels of demand and the market adjusts, the report said.