MBA Chart of the Week Oct. 9: MBA’s Servicing Operations Study and Forum

(Source: MBA’s Servicing Operations Study and Forum; www.mba.org/sosf )

MBA’s annual Servicing Operations Study and Forum (SOSF) includes a deep-dive analysis and discussion of servicing costs, productivity, portfolio characteristics, and operational metrics for in‐house single-family servicers.

Last survey cycle, a total of 30 mortgage servicers provided benchmarking data for the study, representing approximately 60 percent of the residential servicing market.

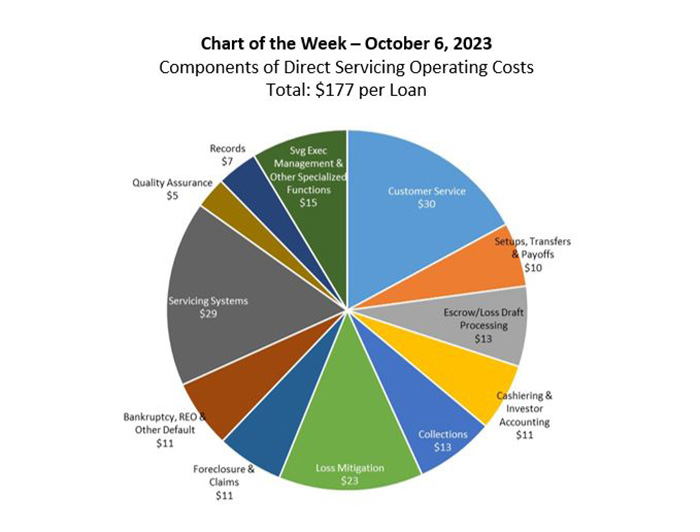

In this week’s Chart of the Week, we show last year’s major components of direct servicing costs by functional area – a key takeaway from the study results. In total, direct servicing costs averaged $177 per loan in 2022, down from $179 per loan in 2021 and well-below the peak of $205 per loan reached in 2013, when default activity was still high and new regulations were being operationalized. About two-thirds of the costs ($119 per loan) related to non-default specific costs such as customer service (call center and borrower communications, including billings), escrow and loss draft processing, servicing set-ups, payoffs and transfers, and executive management. The remaining one-third of the costs ($58 per loan) related to default specific costs such as collections, loss mitigation, bankruptcy and foreclosure. In comparison, default-specific costs were $103 per loan, about 50 percent of total direct costs in 2013. An increase in default activity – whether from natural disasters or homeowner financial distress – could not only result in higher overall direct servicing costs but a higher proportion of costs dedicated to default-specific activities.

Interested in learning more? MBA Research has its annual planning call for interested participants in the 2024 Servicing Operations Study (2023 data) on October 24, 2023, at 2:00 pm ET. We invite all single-family in-house servicers to join us and provide their input on improving this longstanding program. Email us to register for the call.

Note: Direct servicing costs are defined as personnel, occupancy and equipment, and other operating costs needed to service residential mortgages. Direct servicing costs exclude 1) interest expense related to MSR assets, borrower escrows, advances or prepayments; 2) unreimbursed foreclosure, REO and other default costs above the investor reimbursement limit; 3) compensatory fees and indemnifications; and 4) corporate administration costs for legal, finance, human resources, network administration, parent allocations, etc.

Marina Walsh, CMB (mwalsh@mba.org); Jenny Masoud (jmasoud@mba.org)