Zillow: Buyers in The Game, But Interest Rates Keep Sellers on the Bench

Zillow, Seattle, said mortgage rates–both their high levels and their wild swings–are making life difficult for both buyers and sellers.

“Relatively high [interest] rates have brought new listings down to record lows, leaving buyers with limited options,” Zillow said in its February Market Report. “Any dips in mortgage rates are stimulating demand and stiffening competition, but they have been short-lived.”

Zillow Chief Economist Skylar Olsen noted there are many motivated buyers looking for homes at the moment. “When we see mortgage rates fall, sales pick up,” she said. “But buyers are disappointed in their options. Homeowners aren’t giving up their current house and low monthly payments to join a tight, expensive market. Meanwhile, volatility in the economy makes planning extremely difficult.”

The flow of new listings in February set a record low for this time of year, nearly one-third lower than before the pandemic and 22% lower than last year. Olsen said mortgage rates are likely driving the decline–people who bought or refinanced in 2020 or 2021 when rates were well below 3.5% are unwilling to trade in their current mortgage for a new one with double the interest. The largest annual declines in new listings are in West Coast markets including San Jose (-47%), Portland, Ore. (-46%), Seattle (-45%) and Sacramento (-44%).

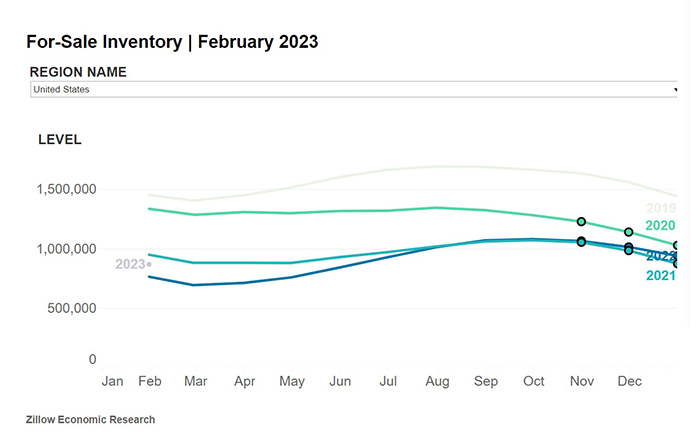

The trickle of new listings contributes to extremely limited total inventory, currently just 17% higher than the absolute bottom seen in February 2022 and about 43% below pre-pandemic norms. “Instead of inventory growing through the first two months of the year, like it did in 2018 and 2019, the number of choices shrank,” Zillow said.

Zillow Senior Economist Jeff Tucker called the market less frenzied than during the last two years, “but home buyers might start to feel some déjà vu at the dearth of options,” he said. “Home sellers seem to be sitting out the early spring selling season in surprising numbers.”

Mortgage rates have been volatile over the past six months, and buyers are responding to the chance to lock in a cheaper monthly payment when the opportunity arises. “Sales activity is picking up, just not accelerating like it usually does at this time of year,” the report said. “After being reinvigorated by lower rates in late January, sales slowed over the course of February as rates hiked back up.”

Ultra-low inventory means when attractive, well-priced houses come on the market, they find buyers easily, Zillow said. Homes that went under contract in February did so after a median span of 17 days. That’s more time than in 2022 and 2021, when time on market was seven and nine days, respectively, but significantly less than before the pandemic.