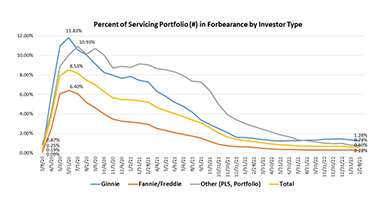

MBA: February Share of Mortgage Loans in Forbearance Decreases to 0.60%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 4 basis points tp 0.60% of servicers’ portfolio volume as of February 28 from 0.64% in January. MBA estimates 300,000 homeowners are in forbearance plans.

MBA: 4Q Commercial, Multifamily Mortgage Debt Outstanding Up By $324B

Commercial/multifamily mortgage debt outstanding at year-end 2022 rose by $324 billion (7.7 percent) from the previous year, the Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding Report said.

CFPB Releases 2022 HMDA Data

The Consumer Financial Protection Bureau on Monday made Home Mortgage Disclosure Act Modified Loan Application Register data for 2022 available through the Federal Financial Institutions Examination Council’s HMDA Platform for more than 4,000 HMDA filers.

SitusAMC: Commercial Real Estate Sentiment Slipping

SitusAMC, New York, said chaos in the capital markets is eroding sentiment for commercial real estate.

HUD Restores ‘Discriminatory Effects’ Rule

HUD on Friday submitted to the Federal Register a Final Rule, Restoring HUD's Discriminatory Effects Standard, rescinding the Department's 2020 rule governing Fair Housing Act disparate impact claims and restoring its 2013 discriminatory effects rule.

MBA Advocacy Update Monday Mar. 20, 2023

On Wednesday, the Federal Housing Finance Agency announced a 90-day delay in the effective date of the new Loan Level Price Adjustments for certain borrowers with debt-to-income ratios above 40 percent. The new effective date will be for deliveries on or after August 1.