SitusAMC: Commercial Real Estate Sentiment Slipping

SitusAMC, New York, said chaos in the capital markets is eroding sentiment for commercial real estate.

“A record number of investors say they would prefer to hold assets rather than buy or sell,” SitusAMC said in its latest ValTrends report, Holding Pattern.

“The first quarter of 2023 found investors waiting to see how higher interest rates and potentially slowing economic growth will change pricing, transaction activity and space market conditions,” said Peter Muoio, Head of SitusAMC Insights. “Transactions have stalled, and the few that have occurred are skewed in a dumbbell pattern–distress and special-story high valuation properties–providing little guidance on where prices stand.”

Meanwhile, SitusAMC Insights Vice President Jen Rassmussen noted space market fundamentals for most segments have not shifted much. “We are some segments that are very healthy and others floundering from longer-standing problems,” she said.

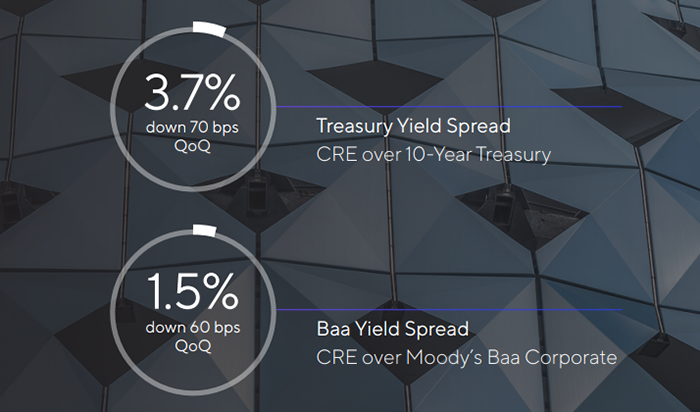

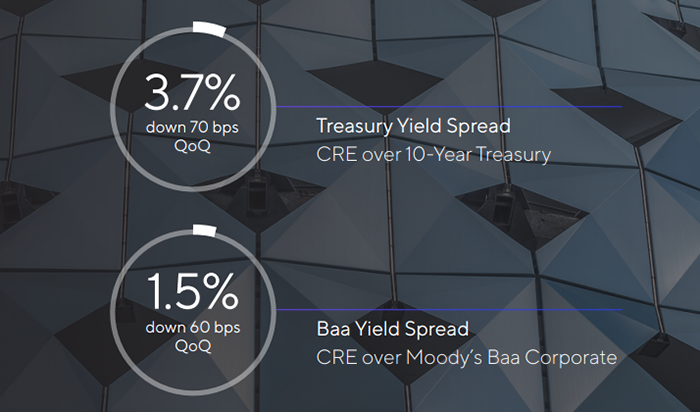

The report said commercial real estate returns fell into negative territory in the fourth quarter and CRE yields over the 10-year Treasury are the narrowest since the Great Recession. “Our on-the-ground intel suggests further retreat in valuations in the first quarter of 2023,” SitusAMC said.

The availability of capital (equity and debt combined) dropped for the fifth consecutive quarter to the lowest level since the Great Recession, the report said. Total commercial real estate returns were also the lowest since the Great Recession, as was capital appreciation.

“Income returns were the second lowest in history,” the report said. “Meanwhile, the overall CRE market was perceived as increasingly risky throughout 2022.”