MBA Advocacy Update, Mar. 6, 2023

The Supreme Court said it would consider the Consumer Financial Protection Bureau’s appeal of the Fifth Circuit Court of Appeals decision in CFSA v. CFPB – in connection to its Payday Lending Rule – over the constitutionality of the Bureau’s funding mechanism.

MISMO Seeks Public Comment on Private-Label RMBS Specification and Implementation Guide

MISMO®, the real estate finance industry standards organization, seeks public comment on the Private-Label Residential Mortgage-Backed Securities (PL RMBS) Specification and Implementation Guide, which will facilitate electronic exchange of mortgage asset data to credit rating agencies.

Survey Finds CRE Executives Remain Optimistic

More than two-thirds of commercial real estate executives maintain a positive outlook despite the highest interest rate environment since 2007 and a looming recession, reported law firm Seyfarth Shaw LLP, Chicago.

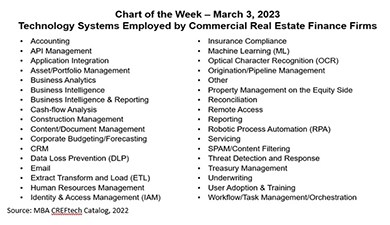

MBA Chart of the Week March 3 2023–Tech Systems Employed by Commercial Real Estate Finance Firms

This week’s Chart of the Week presents findings from MBA’s CREF Technology Catalog, showing the areas in which firms are applying specific tech solutions. What is clear in looking at the industry is that CREF has always relied heavily on technology and does so more and more each year.

The Week Ahead, Mar. 6, 2023: Mssrs. Powell, Chopra Visit Capitol Hill

Good morning and happy Monday. It’s a busy week in Washington, with Federal Reserve Chairman Jerome Powell and Consumer Financial Protection Bureau Director Rohit Chopra scheduled to testify before Congress. But first, here’s what else is happening this week:

Industry Briefs Mar. 6, 2023: Fitch Ratings Says FHA Premium Cuts ‘Credit Neutral’ for Private Mortgage Insurers

Fitch Ratings, New York, said recently announced reductions in the Federal Housing Authority mortgage insurance premium rates are not expected to have a meaningful credit impact on private U.S. mortgage insurance carriers.