Survey Finds CRE Executives Remain Optimistic

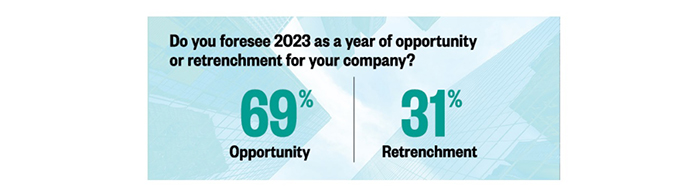

More than two-thirds of commercial real estate executives maintain a positive outlook despite the highest interest rate environment since 2007 and a looming recession, reported law firm Seyfarth Shaw LLP, Chicago.

Though down from 84% who reported having a positive outlook a year ago, this resilient optimism flows in part from better than expected economic growth during the fourth quarter and continuing inflation rate moderation, Seyfarth said in its annual Real Estate Market Sentiment Survey.

The report noted commercial real estate performance is driven by and tied to fundamentals. “Interest rates, a potential recession and inflation remain the top concerns for CRE executives in 2023,” Seyfarth said. Survey respondents were mixed on whether the economy is in a recession or headed for one–and, if so, how long the recession might last.

More than 70 percent of respondents said lowering interest rates would be the most effective way the government could support commercial real estate.

“The Fed’s action on interest rates may not be sufficiently slowing the greater economy, but it is definitely chilling transactional activity,” said Paul Mattingly, Partner and Real Estate Department Chair with Seyfarth. He noted survey respondents tend to be experienced and understand the real estate cycle, “which explains their resilience and optimism.”

Allowing tele-working and hybrid return to office models are now “table stakes” for real estate firms to retain top talent, though 62 percent of executives surveyed reported a corresponding decline in company culture due to less time in the office, the report said. Perhaps in an effort to stem further declines, 85 percent of respondents–who are disproportionately owners and senior executives–said they plan to be in the office 2 to 5 days per week in 2023. “It is unclear whether concerns over culture will trump retention and recruiting and drive the great return to work many CRE executives see as critical to stabilizing assets,” the report said.

Nearly half of respondents said they plan to invest in distressed assets. “For those with money to spend, the decrease in debt availability and rise in financing costs may lead to falling asset values in the market and could explain why, despite these challenges, they see 2023 as a year of opportunity,” the report said.