Mark P. Dangelo: In an AI Reimagined Financial World, It Begins with the Consumer (Part 4)

While leaders in banking, financial services and insurance (BFSI) concentrate on AI solutions, skills and capabilities, and competitive strategies, they are unpleasantly discovering that the application of traditional systems design lacks relevancy when applied to new consumer ecosystem demands. To survive continuous BFSI transformations at the pace of AI advancements, leaders must assess their capabilities not just against competitors—but with new models of business and interlinked consumer behaviors.

Mark Dangelo currently serves as an independent innovation practitioner and advisor to private equity and VC funded firms. He has led diverse restructurings, MAD and transformations in more than 20 countries advising hundreds of firms ranging from Fortune 50 to startups. He is also Associate Director for Client Engagement with xLabs, adjunct professor with Case Western Reserve University, and author of five books on M&A and transformative innovation.

Absolutely and unequivocally the answer is AI—regardless of the technology, organizational capability, or innovation question being asked.

AI is the answer for challenges surrounding legacy systems, shrinking margins, worker and skill set shortages, and consumer behaviors that perplex traditional industry models of strategy, design, and implementation.

If you have a problem, AI is the answer (as evidenced by the nearly $40 billion invested in startups over the last 12 to 15 months alone). Therein resides the problem, the opportunity, and the dilemma for all BFSI and mortgage C-level leaders—how to deliver consumer needs and anticipate competitive behaviors?

As covered in Parts 1 through 3, native digital capabilities shatter the traditional silos and systems common across BFSI organizations. Consequently, the compartmentalization of technologies, processes, and most importantly, data are under pressure by new, non-traditional organizations, which do not have the burden of legacy system thinking and cumbersome infrastructure. For mortgage designs, AI will likely be the catalyst that ushers in straight-through-processing (#STP), shortened cycle times, and a decline in origination, servicing, and securitization costs (as measured against risks).

Adopting emerging strategies to leverage sunk investments and compete within the new BFSI ecosystems, traditional operators are adapting their business models and operating designs to offer their proven back-end solutions using banking-as-a-service (#BaaS) techniques. An example of adapting to ecosystem realities, Goldman Sachs used BaaS to partner with Apple for the latter’s consumer banking entry targeting the 2 billion consumers that are loyal to the Apple brand—and who consistently ranks Apple as one of the most trusted brands in the world while BFSI brands fall by half over the last decade.

As AI rapidly evolves, especially as its capabilities and limitations are assessed within consumer use-cases, the data-decisioning available to BFSI leaders spanning niche demarcations (e.g., prospecting, LMS, underwriting, servicing, securitization tokenization, whole loan markets) will rapidly cycle across new, natively digital banking and lending ecosystems. The reality is that consumer demographics are rapidly evolving, and their impacts on value chains fed by vast data creation and usage are creating unfamiliar ecosystems dead-ending traditional industry mindsets and methods of operation.

What are the Attributes Defining a BFSI Ecosystem?

As articulated in the book The Fourth Industrial Revolution by Klaus Schwab, the blurring of physical and virtual products and services has now spanned BFSI discussions for nearly a decade. The result is that new BFSI ecosystems have spurred rapid innovational changes creating a global gold rush for vast digitization and digital transformations. Moreover, global solution firms—software vendors, management consultants, and IT outsourcers—discussed rationale and implications of business delivery as consumers embraced apps, mobility, cybercurrencies, security, and privacy. The financial industry continues to evolve being pushed forward by the rise of digital innovations representing interconnected platforms, applications, devices, advanced chipsets, and services designed to deliver hyper-personalized value for consumers.

While traditional industry providers created strategy and worried about their legacy infrastructures, numerous non-traditional, innovative BFSI firms launched digital wallets, neobanks, digital assets, and virtual customer experiences that by-passed brick and mortar branches and the digitized paper-based systems common across the middle and back-offices. Additionally, the explosion of financial and regulatory technologies (i.e., #FinTech and #RegTech) systematized data silos solidifying organizational cultures and their resistance to adaptation. Today, these barriers continue to drive complex API’s, interoperability standards, data marts and warehouses, while limiting digitally native organizational capabilities that are embraced by a growing list of non-traditional competitors.

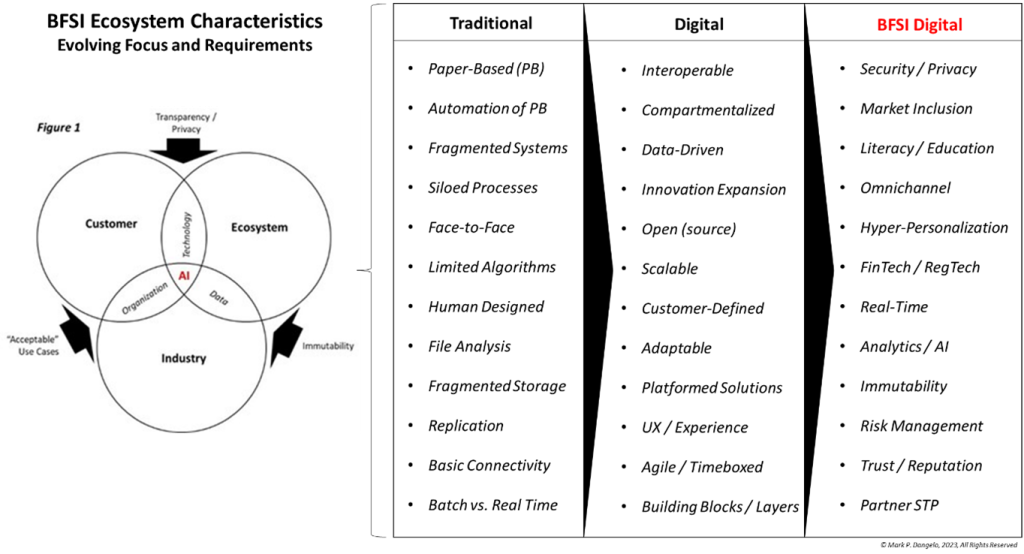

As shown in Figure 1, these characteristics and challenges when viewed from the traditional to the digital to BFSI Digital attributes illustrate the unique, material differences between organizational innovators—and those seeking to enact incremental differences within their delivery ecosystems.

What is also noticeable in the table from the traditional to the BFSI digital, is that the focus on the consumer becomes more prominent. As BFSI develops meaningful use-cases to leverage advancing AI capabilities that integrate with human capabilities, the consumer becomes a critical starting point for Figure 1’s Venn Diagram on the left side. What you also notice and becomes obvious in the remainder of this article is that the customer and ecosystem are primary—the industry is secondary in an AI, data-rich environment. Consumers will rapidly embrace ecosystem providers that deliver value to them.

For BFSI and mortgage leaders, the table illustrates the fundamental shifts that have taken place, and why when it comes to AI solutions, their implementation does not conform to traditional approaches. AI represents the fifth age of computing—one that is natively digital, creates new BFSI and mortgage ecosystem value, and is aligned to consumer behaviors and acceptance—not an industry mindset that was about cost efficiencies and scale.

How do Humans Participate across the AI Solution Sets?

In July 2023, per the Wall Street Journal, Thomas Dohmke, CEO of GitHub stated, “Technology that is not sentient cannot replace human creativity, it can only help deliver it. Right now, AI is just a probability machine, a co-pilot that is symbiotically dependent on its human pilot to build the world’s software.” Indeed, regardless of the advancements made over the next three years, AI will gain advanced BFSI capabilities and become increasingly integrated into operations spurred by exponential data growth and powerful algorithms stacked one upon the other (i.e., ensemble AI).

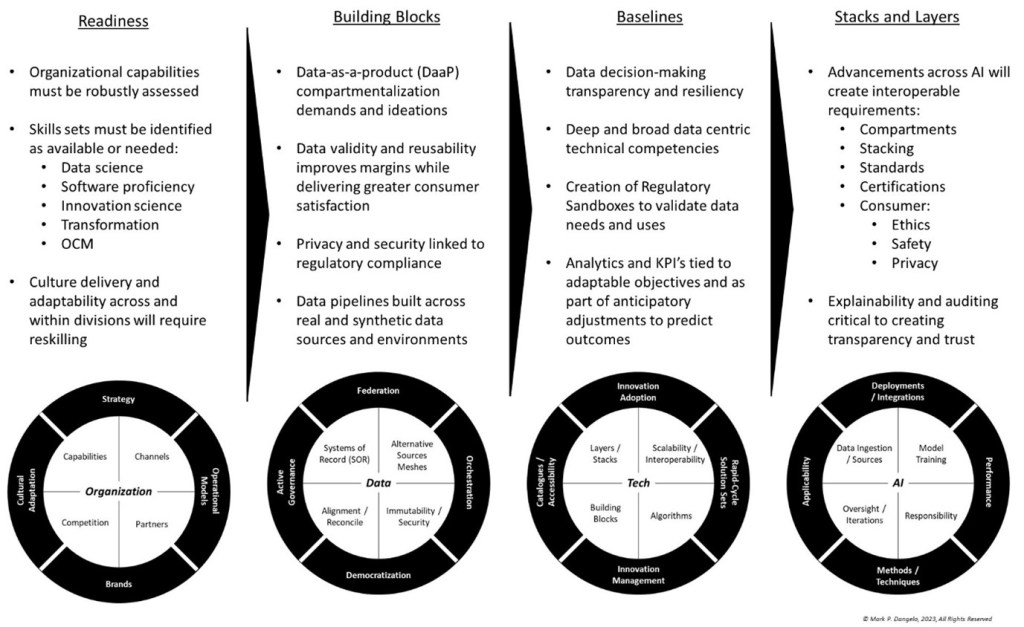

As presented in Part 1, and before organizations commit larger budget percentages to the AI emerging technologies, BFSI leaders need to segment the emerging ecosystem into four categories each possessing distinctive characteristics. In the illustration below each of these categories—organization, data, technology, and AI—represent discrete strategies and designs. These interconnected “crawl-walk-run” categories, create a framework for action that can be utilized to methodically, purposefully embrace AI while leveraging the experiential knowledge existing with BFSI and mortgage divisions. It provides the ecosystem context necessary to participate and leverage AI solutions.

At the bottom of the illustration above, each category is broken down into actionable taxonomies that can be assessed and provisioned using available products, services, and skills. What this model provides is a structure that merges and elevates AI with “humans-in-the-loop.” The greatest financial return and customer satisfaction demonstrated across case studies is that when AI underpins skilled, industry knowledgeable individuals the lasting benefits and life-cycle success results in ecosystem brand trust and consumer demand.

Indeed, the framework discussed over this series may be unfamiliar. Indeed, the idea of adapting to digital ecosystem attributes seems esoteric. Indeed, industry culture transformation in an “Age of AI” across Industry 4.0 requirements is challenging. Indeed, the pressures for BFSI and mortgage industry change, for STP, for regulatory demands, for legal risks, for digital value creation are implications of the AI halos being advocated in the media, at conferences, and within meetings every day. In the end, these drivers will escalate as the breadth and scale of AI encroaches on BFSI traditional solutions and practices (e.g., LMS, data aggregators, inclusion efforts, credit worthiness).

Yet, the opportunity and benefits of AI utilizing a new framework of design and implementation can create not just profitability due to improved accuracy, time-value, and cost elimination, but also impact the “pull” of brands and operations (see Part 1) who deliver for the consumer (see Part 2) and across industry shifts (see Part 3).

In Conclusion, are BFSI and Mortgage Leaders Asking the Right Questions Surrounding AI?

AI is undergoing its halo stage—but clouds are forming. The system ideation approaches that have dominated industry architecture and mainstream cloud infrastructures are losing their value as AI and native digital solutions remake the supply chains of BFSI and mortgage products and services. One must only look at the decades-long decline of traditional brands and the rise of non-traditional brands, virtual institutions, and payment solutions embraced by consumers to understand that competition and consumer acceptance are transitioning.

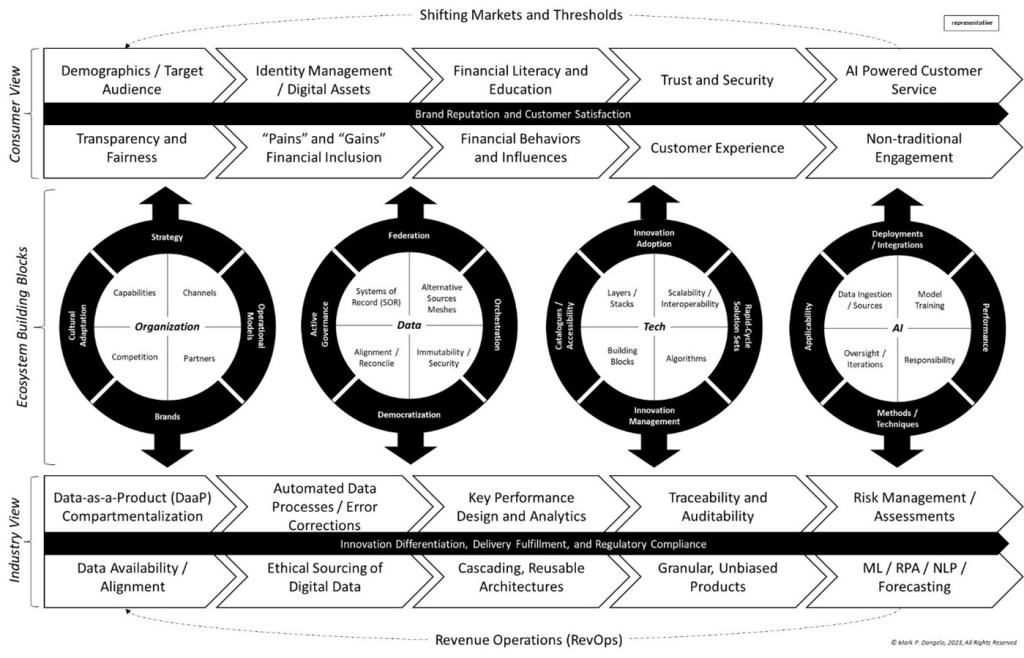

Below is AI Reimagined Financial World, It Begins with the Consumer framework spanning all four parts of this series. As illustrated, the value processes of the consumer and industry surrounding the emerging BFSI ecosystem categories showcase an AI framework approach that moves beyond the traditional to leverage experential human skills. It is an AI BFSI innovation design integrating an engineering mindset of crawl-walk-run for the emerging financial data supply chains.

Finally, as banking assets become increasingly concentrated in the top 25 institutions domestically, their governance and oversight begin to resemble highly regulated public utilities designed to ensure the safeness and soundness of the financial system. Yet, this concentration is not comprehensively embraced by consumers as evidenced by their support of peer-to-peer payment systems. AI capabilities will fuel non-traditional approaches to BFSI products and services creating profitable and sought after opportunities for small firms and independent operators.

And, unlikely to make industry friends, it is anticipated that the mortgage market will most likely be disintermediated given its legacy fragmentation, and its extensive and valuable efforts embracing standards and FinTech / RegTech solutions. Foundationally, AI advancements will flourish when applied to transformative finance and lending digital demands within a vastly different ecosystem—ones that were not designed nor constrained by the automation of traditional paper-based processes.

As politicians ramp up regulations and limited commitments from exceptionally large tech firms, the innovation and advancements will dwarf efforts to put the AI Genie back into the bottle. Since the 1970’s computer and data sciences have been striving to get to this stage—to this level of acceptance. It was not industry that embraced the efforts—it began with consumers and their demand for “innovation singularity” all the while creating new methods of data exchanges and product and service values.

AI has both halos—and horns—yet the framework we have discussed delivers an adaptability and evolution landscape that benefits everyone—consumers, economic value, large and small firms. AI is here to stay—it remains to be seen who will become the BFSI and mortgage leaders in just two years.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to NewsLink Editor Michael Tucker at mtucker@mba.org or Editorial Manager Anneliese Mahoney at amahoney@mba.org.)