MBA Weekly Survey Feb. 1, 2023: Applications Drop Despite 4th Week of Falling Rates

Mortgage applications fell from one week earlier despite another drop in interest rates, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending January 27.

Home Price Report Roundup: More Rebalancing

Three reports show a continuing trend of slowly receding home prices, with some markets coming back to earth faster than others. Here’s a summary of those reports:

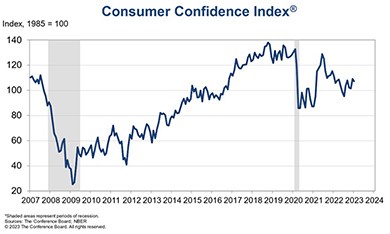

Recession Fears Fuel Dip in Consumer Confidence

The Conference Board, New York, said its Consumer Confidence Index fell in January following an upwardly revised increase in December.

Inflation Spurs Consumers to Credit Cards, Home Equity

TransUnion, Chicago, said amid rising interest rates and high inflation, the fourth quarter saw consumers continuing to look to credit as a means to help stave off financial pressures.

Dealmaker: Merchants Capital Secures $77M for St. Paul Affordable Housing Project

Merchants Capital arranged the debt financing for Soul totaling more than $77 million. The firm secured a $33 million Merchants Bank of Indiana construction loan, a $16.6 million MBI equity bridge loan and a $27.45 million Freddie Mac Tax-Exempt Loan to comprise the total $77 million. RBC Capital Markets served as the equity provider for the project.