MBA: 4Q Mortgage Delinquencies Increase

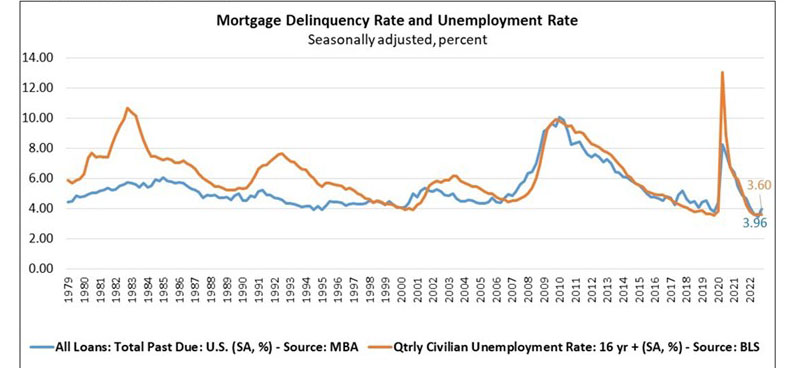

Mortgage delinquencies rose to near 4 percent in the fourth quarter, the Mortgage Bankers Association reported Thursday, but remained near survey lows.

The MBA Quarterly National Delinquency Survey reported the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.96 percent of all loans outstanding at the end of the fourth quarter, up 51 basis points from the third quarter but down 69 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the fourth quarter fell by 1 basis point to 0.14 percent.

“As expected, the overall national mortgage delinquency rate increased in the fourth quarter of 2022 from its previous quarterly survey low,” said Marina Walsh, CMB, MBA Vice President of Industry Analysis. “The weaker economy and ongoing inflationary pressures contributed to the uptick in delinquencies. The delinquency rate – while still low – increased from the previous quarter across all loan types and across all stages of delinquency.”

Walsh said for the past 15 years, mortgage delinquencies have tracked very closely with employment conditions. Despite recent indicators of resiliency in the job market, including the unemployment rate declining to 3.4 percent in January, MBA still forecasts for slower hiring and rising unemployment, with the rate rising to 5.2 percent by the end of the year. This will likely mean further increases in mortgage delinquencies.

“Notwithstanding the fourth-quarter increase in mortgage delinquencies, the foreclosure starts rate of 0.14 percent was well below the historical quarterly average of 0.40 percent,” Walsh said. “Many distressed homeowners have loss mitigation options available to them and have accumulated home equity, which can ease financial hardship and avert foreclosure actions.”

Key findings of MBA’s Fourth Quarter National Delinquency Survey:

· From the third quarter, the seasonally adjusted mortgage delinquency rate increased for all loans outstanding. By stage, the 30-day delinquency rate increased by 26 basis points to 1.92 percent, the 60-day delinquency rate increased by 13 basis points to 0.66 percent, and the 90-day delinquency bucket increased by 11 basis points to 1.38 percent.

· By loan type, the total delinquency rate for conventional loans increased by 26 basis points to 2.78 percent over the third quarter. The FHA delinquency rate increased by 209 basis points to 10.61 percent, and the VA delinquency rate increased by 45 basis points to 4.16 percent.

· Year-over-year, total mortgage delinquencies decreased for all loans outstanding. The delinquency rate decreased by 80 basis points for conventional loans, by 15 basis points for FHA loans, and by 108 basis points for VA loans from the previous year.

· The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter rose slightly to 0.57 percent, up by 1 basis point from the third quarter and by 15 basis points higher from a year ago.

· The non-seasonally adjusted seriously delinquent rate (the percentage of loans that are 90 days or more past due or in the process of foreclosure) fell to 1.89 percent. It decreased by 1 basis point from last quarter and decreased by 94 basis points from last year. The seriously delinquent rate decreased by 5 basis points for conventional loans, increased by 14 basis points for FHA loans, and decreased by 8 basis points for VA loans from the previous quarter. From a year ago, the seriously delinquent rate decreased by 68 basis points for conventional loans, decreased by 208 basis points for FHA loans and decreased by 139 basis points for VA loans.

· States with the largest quarterly increases in their overall delinquency rate were Louisiana (77 basis points), Florida (74 basis points), Indiana (62 basis points), West Virginia (55 basis points), and Mississippi (55 basis points).

· Note: For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.