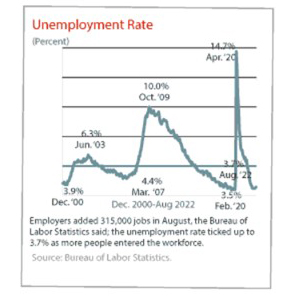

MBA Weekly Survey Sept. 14, 2022: Applications Fall 6th Straight Week; Interest Rates Top 6%

Mortgage applications fell for the sixth straight week as interest rates topped 6 percent, although purchase applications showed signs of life, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 9.

MBA, Trade Groups Urge National Economic Council to Support FHA Insurance Premium Reduction

The Mortgage Bankers Association and other industry trade groups urged the National Economic Council to support a reduction of the annual mortgage insurance premium for borrowers with FHA-insured loans.

#MBARMQA22: Strategies for Detecting Fraud

NASHVILLE, TENN.—The current mortgage fraud environment is evolving, with new risks emerging in a post-pandemic environment, analysts said here at the MBA Risk Management QA and Fraud Prevention Forum.

#MBARMQA22: Focusing on the Weakest Links

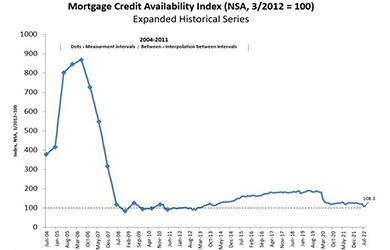

NASHVILLE, TENN.—The housing market today is nothing like 2008, said Christa Lynn Greco, IA with the Criminal Investigative Division of the Federal Bureau of Investigation, Washington, D.C. But she said changing market conditions make the potential for mortgage fraud ever-present.

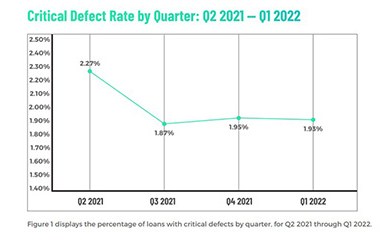

Critical Defect Rate Falls for 2nd Straight Quarter

ACES Quality Management, Denver, said the overall critical defect rate declined for the second straight quarter despite a more challenging mortgage lending environment.

Colliers: Potential Inflection Point for CRE

Commercial real estate capital markets could be at an inflection point amid volatile economic conditions, said Colliers International, Toronto.

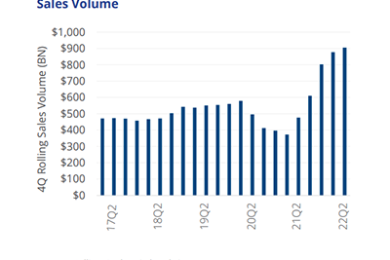

MBA: 2Q Commercial/Multifamily Mortgage Delinquency Rates Decline

Commercial and multifamily mortgage delinquencies declined in the second quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report said.