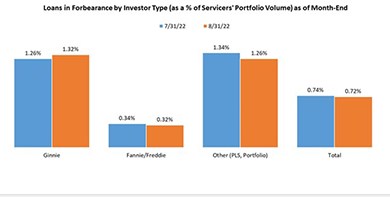

MBA: August Share of Mortgage Loans in Forbearance Falls to 0.72%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans now in forbearance decreased by 2 basis points from 0.74% of servicers’ portfolio volume in the prior month to 0.72% as of August 31. MBA estimates 360,000 homeowners are in forbearance plans.

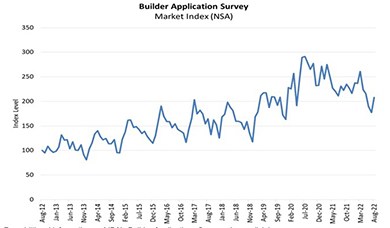

MBA Builder Applications Survey Up 17% from July

The Mortgage Bankers Association Builder Applications Survey reported mortgage applications for new home purchases in August rose by 17 percent from July—the first monthly increase in four months—but fell by 10.1 percent from a year ago.

MBA: 2Q Commercial/Multifamily Mortgage Debt Outstanding Up by $99.5B

Commercial/multifamily mortgage debt outstanding increased by $99.5 billion (2.3 percent) in the second quarter, the Mortgage Bankers Association reported in its quarterly Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

David Battany Represents MBA Today Before Senate Committee

David Battany, Vice President of Capital Markets with Guild Mortgage Co., San Diego, and a member of the MBA Residential Board of Governors, testifies this Tuesday, Sept. 20 before the Senate Banking Subcommittee on Housing, Transportation and Community Development for a hearing on Examining the U.S. Department of Agriculture’s Rural Housing Service: Stakeholder Perspectives.

MISMO Releases New Reference Model for Public Comment

MISMO®, the real estate finance industry standards organization, seeks public comment on Version 3.6 of the MISMO Reference Model, which includes new data points and structures related to a number of important industry business, regulatory and investor changes.

Inflation’s Impact on Retail Real Estate

Colliers International, Toronto, said consumers are not alone in feeling elevated inflation--higher costs are problematic for retailers, too.